Mumbai-based Lodha Developers today acquired

iconic Macdonald House that houses the Canadian High Commission in

central London for over 300 million pounds (over Rs 3,000 crore) and

said it would expand presence in the UK property market to encash

opportunities. "Lodha Group has exchanged contracts to acquire the

landmark MacDonald House in Prime Central London from the Canadian

government for a consideration of over GBP 300 million (over Rs 3,000

crore)," Lodha said in a statement. The acquisition marks foray of

Lodha Group into the UK real estate market. This is the third major

asset purchase by the privately held firm in over last one year. Lodha

had bought 17 acres of land in Mumbai from DLF for Rs 2,727 crore and

also Washington House property from the US government on Altamount Road

in Mumbai for about Rs 375 crore. Canada's High Commissioner to the UK,

Gordon Campbell, confirmed last night that legal contracts have been

exchanged for the sale of 1 Grosvenor Square for 530 million Canadian

dollars. "We thank Lodha Group for their keen interest and welcome this

new phase in the project," Campbell said. The High Commission said

Lodha will acquire the property, which offers 1.5 lakh sqft of

developable area. "The acquisition of this marquee asset overlooking

London's most renowned garden square, in the heart of Mayfair, and in

close proximity to Bond Street and Mount Street is a great opportunity

for our company," Lodha Group Managing Director Abhishek Lodha said.

Meanwhile, Lodha Deputy MD Abhinandan Lodha said it plans to focus on

Mumbai and London. The firm sees great opportunity in the UK and would

like to expand its presence in the region. "The deal will be completely

through internal accruals. We have already made payment of the first

tranche of Rs 300 crore and the rest we intend to pay before March next

year," he told reporters in Mumbai. Lodha has cash funds of Rs 14,500

crore from sales in last 18-19 months and earned revenue of Rs 8,700

crore in FY13. He said no plan has been finalised on development of the

property acquired.

Friday, November 29, 2013

INTEREST ON SB ACCOUNTS EVERY QUARTER

Bank customers will now get interest on

their savings account as well as term deposits at an interval shorter

than a quarter, as per a new directive of the Reserve Bank. Most of the

banks currently credit the interest accrued on the savings accounts

every six months. "...banks will now have the option to pay interest on

rupee savings and term deposits at intervals shorter than quarterly

intervals," RBI said in a notification today.

As per the earlier norms, banks were instructed to pay interest on savings at term deposits on rupee deposits held in domestic, Ordinary Non-Resident (NRO), Non-Resident Special Rupee (NRSR) and Non-Resident (External) (NRE) at quarterly or longer intervals. RBI said however that as banks are now functioning on core banking platform so it was decided to review the previous instructions. Accordingly, banks will now have the option to pay interest on rupee savings and term deposits at intervals shorter than a quarter. The revised instructions, the RBI said, are applicable to domestic Rupee deposits including Ordinary Non-Resident (NRO) and Non-Resident (External) (NRE) savings and term deposits. In a separate notification, RBI allowed the banks the freedom to offer interest rates on incremental NRE deposits with maturity of three year and above without any ceiling until January 31, 2014.

As per the earlier norms, banks were instructed to pay interest on savings at term deposits on rupee deposits held in domestic, Ordinary Non-Resident (NRO), Non-Resident Special Rupee (NRSR) and Non-Resident (External) (NRE) at quarterly or longer intervals. RBI said however that as banks are now functioning on core banking platform so it was decided to review the previous instructions. Accordingly, banks will now have the option to pay interest on rupee savings and term deposits at intervals shorter than a quarter. The revised instructions, the RBI said, are applicable to domestic Rupee deposits including Ordinary Non-Resident (NRO) and Non-Resident (External) (NRE) savings and term deposits. In a separate notification, RBI allowed the banks the freedom to offer interest rates on incremental NRE deposits with maturity of three year and above without any ceiling until January 31, 2014.

GOA OVERTAKES KERALA

International travel magazine Conde Nast has

chosen Goa as the best leisure destination in the country overtaking

Kerala. The erstwhile Portuguese colony was awarded as the best leisure

destination by the Conde Nast Traveller India's Readers' travel awards,

a statement from the Goa Tourism issued today said. The award comes

after the state, famous for its beaches, watersports, offshore gambling

and cheap alcohol, reported a 10 per cent rise in tourist arrivals, the

statement said. With safety of women being a concern, the Goa Tourism

said the BJP-governed state has resolved to fight the menace and will be

introducing women taxi drivers during the peak arrival season which is

set to begin soon. The women taxi services will be available in the

capital Panjim, and other major cities like Margao, Mapusa and Vasco,

exclusively for women passengers and families, it said. The tourism

season in the state will start with upcoming Feast of St Francis Xavier

that will be celebrated at the Basilica of Bom Jesus, Old Goa on

December 3, it said.

VOW...WHAT A SAY...FMJI

There

are "no quick fixes" for taming food prices and the monetary policy

has little impact on curbing the rate of price rise. The demand for protein based

items and fruits and vegetables is high. There is no easy solution to taming

food inflation... We are paying a political price for that and I acknowledge

that but those are the facts.

We

will continue to work till last day of this government. I can pledge on behalf

of my government that we will work everyday until the last day of the term of

this government. Whether we have taken right decisions, will be known as the

(elections) results come in.

WEEKLY ASTRO GUIDE (02.12.2013 to 06.12.2013)

CRUCIAL WEEK WITH BULLISH BIAS

Planetary

Position :: During the current week Moon would be

transiting from Anuradha in Scorpio to Uttarashadha in Capricorn . Sun transits in Jyeshta constellation in Scorpio. Mercury ,transits in Visakha and Anuradha constellations in Anuradha. Mars transits in Uttara constellation in Virgo. Saturn continues in Visakha constellation in Aries and Taurus navamsas. Jupiter transits in Retrograde motion (till 6th March 2014) in Gemini and presently in Taurus Navamsa . Venus transits in Uttarashadha constellations in Sagittarius and Capricorn sign. Astrologically, further rise is possible before major correction in Second half of the month.

transiting from Anuradha in Scorpio to Uttarashadha in Capricorn . Sun transits in Jyeshta constellation in Scorpio. Mercury ,transits in Visakha and Anuradha constellations in Anuradha. Mars transits in Uttara constellation in Virgo. Saturn continues in Visakha constellation in Aries and Taurus navamsas. Jupiter transits in Retrograde motion (till 6th March 2014) in Gemini and presently in Taurus Navamsa . Venus transits in Uttarashadha constellations in Sagittarius and Capricorn sign. Astrologically, further rise is possible before major correction in Second half of the month.

Nifty

Outlook for Next Week :: 02.12.2013 to 06.12.2013 (Further Rise

Possible)…

NIFTY

:: 6176(+181)

Nifty snapped

Three week fall and registered a rise of about 3% during the week. However,

calendar month closed with a loss of about 2% and November Derivative series

too closed with a loss of about 3%. As written in last week’s column, a relief

rally was witnessed amid bearish sentiment and sentiment has become cautiously

optimistic now, Current week and early part of next week is crucial as State

Elections results and their expectations would be keenly watched by market participants. Based

on the last week’s rise, based on technicals, further rise is possible. IF

Election results are taken positively by the market, Nifty could seek higher

levels and register a new High during this month. Positive feature of the

current rise is the participation of several midcap stocks which have registered

smart rise. While further rise is possible, stock selection has become an

important factor as several stocks continue to remain laggards. Hence,

investors with Medium / long term horizon need to exhibit patience as stocks

selected by them might not perform. Hence an approach combining Technicals and

Fundamentals is required to spot winners. Further, Nifty has been trading in a

range of 4600 to 6300 for more than 4 years and is due for a powerful

breakout sooner than later. All eyes are on forth coming State Elections which

could be viewed as a prelude for the forthcoming Big fight. Stock market

discounts future in advance and is ahead of economy and fundamentals atleast by

Six months. and medium term bullish sign in markets presupposes improving

fundamentals as is evidenced by market reports that earnings are improving and

recent GDP data too is indicative of the same. Nifty has been making

higher bottoms and can be expected to breakout and make higher tops. “Buy on

Decline” may be followed for Medium / long term. Traders should be ever

vigilant to track short term movements . Presently short term movement too is

positive and long positive may be continued with a stop loss of 6050 on close

basis. Nifty is above 200 DMA and 50 DMA and the

50DMa also has crossed 200DMA and makes

a clear case of “Buy on Decline” with 200 DMA as stop loss. .

For the coming week, Nifty spot is expected to face resistance at

6255, 6335, 6415 and find support at 6100, 6020, 5940.

Nifty , presently in short term bullishness, would reverse only on a close below 6050.

Advice

for Traders :: Nifty had come out of short term bearishness during last week

and remains bullish as long as it closes above 6050. One more positive weekly

close would take the market further up. Hence current week should be keenly

watched for further market movement and long positions may be continued with

aforementioned stop loss.

WD Gann’s

natural numbers which would act as natural support and resistance are

, :5891, 5968, 6046, 6124, 6202 ,6281, 6361, 6441 during the week.

natural numbers which would act as natural support and resistance are

, :5891, 5968, 6046, 6124, 6202 ,6281, 6361, 6441 during the week.

Further , Weekly Open level is very important for the entire

week.

Short positions may be avoided as long as it maintains / closes above

Weekly open and vice versa

Short positions may be avoided as long as it maintains / closes above

Weekly open and vice versa

MID SESSION BETTER (FOR MONDAY)

Nifty closed with a gain of more than 1% and appears to have

cleared the neutral zone. However, one more positive close would confirm the

same. Nifty spot is expected to

encounter resistance at 6215, 6250 and find support at 6140, 6100 for Monday.

While Global cues and Funds flow are expected to broadly guide the market

movement, based on the present market position, market is expected to be

generally better in the mid session and

might face selling pressure in the closing session.

Nifty

Review for Friday, 29th

November, 2013 :: December Series Opens with a Bang ..!!

Market opened steadily and immediately surged

more than 1% and traded in a narrow range thereafter to close with a

gain of more than 1%..However, November calendar month ended up with a loss of

about 2%. All sectoral indices closed in

the green and notable gainers include Bank, Metal, Infra, Realty, FMCG etc., 42

of Nifty stocks gained and broader market too was positive with Advance Decline

ratio placed at 1.8 :1. NMDC, Bank of Baroda, , SSLT, BHEL, PNB remained

major gainers among Nifty stocks while M&M, Hero Motors, Wipro,

NTPC, Asian Paints remained losers among

Nifty stocks.

Among F&O stocks,

JP Associates, Syndicate Bank, NMDC, Bank Baroda, PFC remained

major gainers while Jubilant

Food, MRF, M&M, UBL, Apollo Tyres

remained losers.

Inputs provided by

Dr.Bhuvanagiri Amaranatha Sastry

Astro Technical Analyst

Saketha Consultants, Hyderabad

He can be reached @sastry.saaketa@gmail.com

09848014561

Thursday, November 28, 2013

NIFTY OUTLOOK FOR 29th NOVEMBER

SECOND HALF SUBDUED

Nifty closed with a gain of more than 0.50%. It continues to

remain neutral range between short term

support and resistance. 6025 can be considered strong short term support and

6175 can be considered resistance. Nifty

spot is expected to encounter resistance at 6135, 6170 and find support at 6055,

6020 for Friday. While Global cues and

Funds flow are expected to

broadly guide the market movement, based on the present market position, market

is expected to be generally better in the forenoon and might face selling

pressure in Second half of the day.

Nifty 6092 +35

Review for Thursday, 28th

November, 2013 :: Generally Better ..!!

Market opened better and traded in a narrow range and closed

with a gain of more than 0.50% but

November Derivative series ended up with a loss of about 3%. All sectoral

indices closed in the green and notable gainers include Infra, Media, Realty,

Metal, Energy etc., 46 of Nifty stocks gained and broader market too was

positive with Advance Decline ratio placed at 1.6 :1JP Associates, BHEL,

Grasim, Power Grid remained major gainers among Nifty stocks while Cairn,

Cipla, Tata Motors, NMDC remained losers

among Nifty stocks.

Among F&O stocks,

Voltas, Dish TV, Adani Enterprises, JP Associates remained

gainers while Grasim, Hind Zinc,

Federal Bank, Tata Motors DVR

remained major losers.

Inputs provided by

Dr.Bhuvanagiri Amaranatha Sastry

Astro Technical Analyst

Saketha Consultants, Hyderabad

He can be reached @sastry.saaketa@gmail.com

09848014561

Wednesday, November 27, 2013

ZIMBABWE BANS FORIEGN BUSINESSES

Zimbabwe will press ahead with controversial

plans to ban foreigners from owning bakeries, barber shops, estate

agencies and a host of other businesses, officials said today.

"Foreigners operating in reserved sectors of the economy have been given

January 1 as the deadline to comply with regulations," a government

official told AFP. The businesses to be owned by locals include

bakeries, barber shops, beauty salons, estate agencies, grain mills,

milk processing plants, retail outlets, tobacco processing, transport

and valet services. The rules have been on the books since 2010, but

have not yet been enforced. Long ruling President Robert Mugabe won

another term three months ago and has vowed to continue with economic

empowerment regulations. So far the drive to put Zimbabweans in charge

has been limited to white-owned farms and some western owned businesses.

The January deadline is set to affect nationals from China, the

Democratic Republic of Congo, India, Nigeria and Pakistan, among others.

Simon Udemba, president of the Nigerian Community in Zimbabwe, urged

the government to reconsider. "I would like to plead with the

Zimbabwean government and people to be considerate in effecting this

exercise," Udemba told AFP. "As an African and resident of Zimbabwe I

am particularly concerned if the approach will be economically

beneficial for the country." He said Nigerians in Zimbabwe are

contributing to the development of the country and that they should not

be forced out of business. "I believe Nigerians are providing necessary

services. Nigerians have been here with Zimbabweans through all these

years of isolation by the West, they never deserted Zimbabwe," he said.

"They have been in Zimbabwe through thick and thin, they live here with

their families. Nigerians in Zimbabwe are doing genuine business and

are servicing the economy positively." "In my view there is no black

African that should be called a foreigner in any black African land, we

should look at one another as brothers."

NIFTY OUTLOOK FOR 28th NOVEMBER & MARKET REVIEW OF 27th NOVEMBER

SCRIP SPECIFIC MOVEMENT

Nifty closed flat and appears in a narrow range between

short term support and resistance. 6025 can be considered strong short term

support and 6175 can be considered resistance. Nifty spot is expected to encounter resistance

at 6100, 6135 and find support at 6020, 5985 for Thursday. While Global cues

and Funds flow are expected to broadly guide the market

movement, based on the present market position, market is expected to display volatile

movements with alternate bouts of bullishness and bearishness and scrip

specific movements are most likely in view of the last day of Derivative

expiry.

Nifty

Review for Wednesday,

27th November, 2013 :: Lackluster Movement

..!!

Market traded in a narrow range and closed flat for the day.

Market appears to be in a cautious mood ahead of F&O expiry and on the eve

of mini election battle. 29 of Nifty

stocks closed in the red and broader

market too was negative with Advance

Decline ratio placed at 1:1.4. Auto, FMCG, Metal indices gained while IT,

Infra, Realty, PSU Bank and Pharma indices slipped. Tata Motors, BPCL, Grasim,

Ultra Cement, Axis Bank remained gainers among Nifty stocks while JP

Assiociates, Power Grid, Bharti, DLF, NTPC remained major losers among Nifty stocks.

Among F&O stocks,

HDIL, Voltas, PTC, UPL, JSW Steel

remained gainers while Adani Ports, JP Associates, Orient

Bank, Glenmark, Siemens, LIC Housing

remained major losers.

Dr.Bhuvanagiri Amaranatha Sastry

Astro Technical Analyst

Saketha Consultants, Hyderabad

He can be reached @sastry.saaketa@gmail.com

09848014561

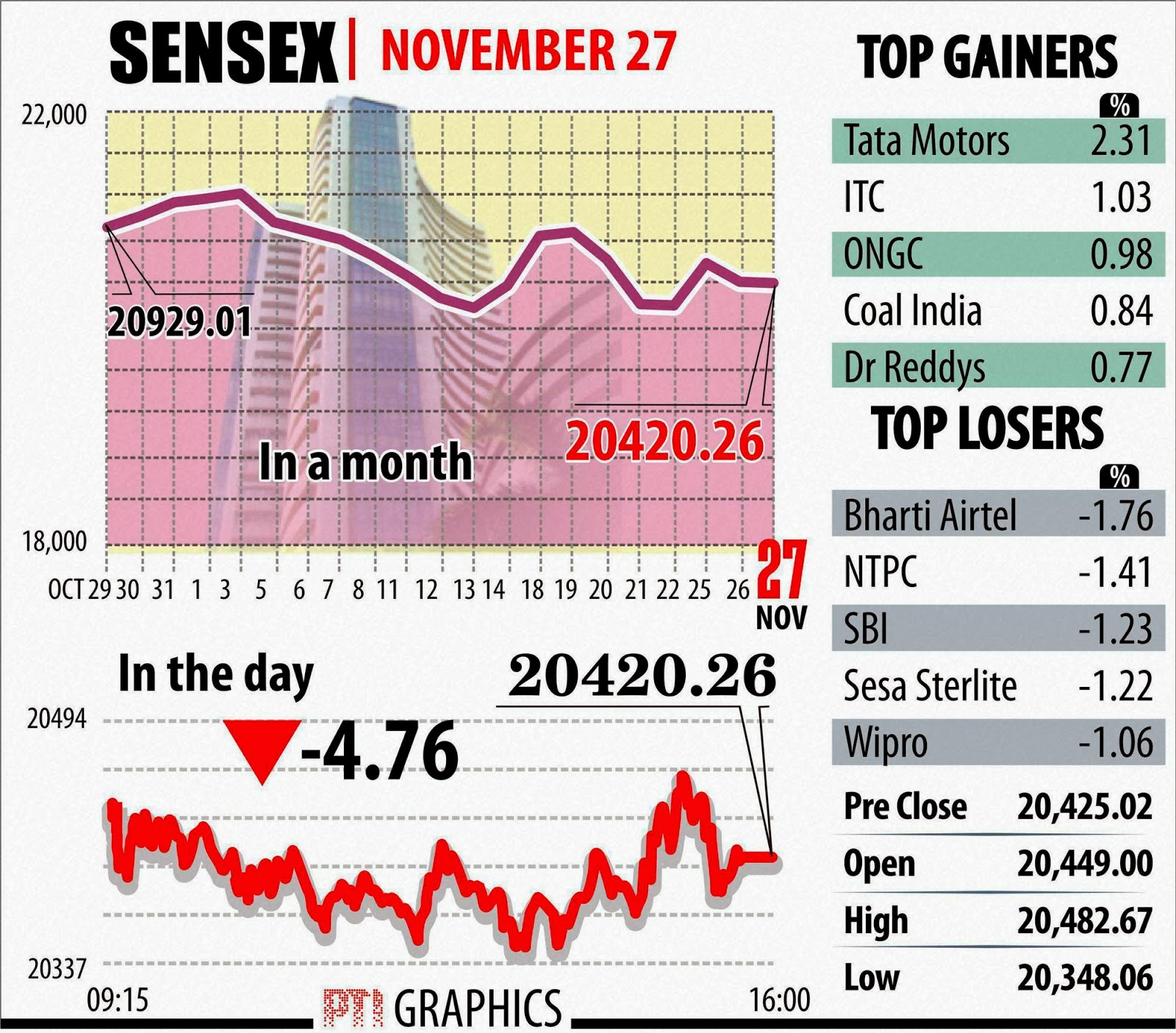

SENSEX ENDS IN RED AFTER

CHOPPY SESSION

The benchmark Sensex fell 5

points after a choppy session today on the eve of the expiry of November

derivative contracts and ahead of GDP and fiscal deficit data due on Friday.

Heavyweights Infosys and Reliance Industries dragged the index lower even as

ITC and Tata Motors provided some support. Bharti Airtel, NTPC and State Bank

of India were the biggest of the 16 losers on the Sensex.

The S&P BSE Sensex opened higher at 20,449. It traded within a band of 20,348.06 to 20,482.67 before closing at 20,420.26, a drop of 4.76 points or 0.02 per cent. US is nearing the Thanksgiving holiday weekend, also impacted market movement across the globe. Indian markets too are seeing sideways movement. The 50-share CNX Nifty on the National Stock Exchange eased by two points to 6,057.10. Power, realty and IT shares led six of the 13 BSE sectoral indices down. IT stocks fell as the rupee continued to strengthen against the dollar, reducing the value of their overseas earnings when converted into the local currency. Fresh capital outflows affected sentiment. Overseas investors sold a net Rs 339.16 crore of shares yesterday, according to provisional data on the stock exchanges. The decline in the markets was stemmed by consumer durables and FMCG sector shares, which advanced. Brokers said there was volatility in the market as some investors booked profits while others sought to cover their pending long positions before the expiry of futures and options contracts tomorrow. The quarterly GDP estimate for July-September and fiscal deficit data is scheduled to be released on November 29. The rupee traded stronger at 62.2 levels against the dollar after a disappointing report on US consumer confidence in November.

The S&P BSE Sensex opened higher at 20,449. It traded within a band of 20,348.06 to 20,482.67 before closing at 20,420.26, a drop of 4.76 points or 0.02 per cent. US is nearing the Thanksgiving holiday weekend, also impacted market movement across the globe. Indian markets too are seeing sideways movement. The 50-share CNX Nifty on the National Stock Exchange eased by two points to 6,057.10. Power, realty and IT shares led six of the 13 BSE sectoral indices down. IT stocks fell as the rupee continued to strengthen against the dollar, reducing the value of their overseas earnings when converted into the local currency. Fresh capital outflows affected sentiment. Overseas investors sold a net Rs 339.16 crore of shares yesterday, according to provisional data on the stock exchanges. The decline in the markets was stemmed by consumer durables and FMCG sector shares, which advanced. Brokers said there was volatility in the market as some investors booked profits while others sought to cover their pending long positions before the expiry of futures and options contracts tomorrow. The quarterly GDP estimate for July-September and fiscal deficit data is scheduled to be released on November 29. The rupee traded stronger at 62.2 levels against the dollar after a disappointing report on US consumer confidence in November.

SENSEX LOOSERS

The major Sensex losers were

Bharti Airtel (-1.76 pc), NTPC (-1.41 pc), SBI (-1.23 pc), Sesa Sterlite (-1.22

pc) and Wipro (-1.06 pc). Hero MotoCorp was unchanged while Tata Motors firmed

up 2.31 pc, ITC 1.03 pc, ONGC 0.98 pc, Coal India 0.84 pc and Dr Reddy's

Laboratories 0.77 pc. Among the S&P BSE sectoral indices, Power fell 0.88

pc, Realty 0.77 pc, IT 0.66 pc and Teck 0.65 pc, while Consumer Durables rose

1.37 per cent, FMCG 1.03 pc and Auto 0.97 pc. The market breadth remained

negative as 1,362 stocks ended lower, 1,111 finished higher and 158 ruled

steady. Total turnover dropped sharply to Rs 1,828.15 crore from Rs 3,944.46

crore yesterday.

Tuesday, November 26, 2013

REALTY FOCUS ON SENIOR CITIZENS

Pune-based real estate firm Gagan Group today said it is investing Rs 160 crore to set up resorts for senior citizens at Lonavala. The project, NULIFE, will have apartments starting from Rs 35 lakh, and will be equipped with medical facilities and other requirements needed for seniors. Lonavala is a popular hill station located about 65km from Pune city. "We are investing around Rs 160 crore to set up India's first world-class project of resort residences for seniors - NULIFE. We have already spent Rs 50 crore for acquisition of 14 acres of land and investing another Rs 110 crore to construct a residential complex for senior citizens," Gagan Group Director Alnesh Somji told PTI here. The project is a living retreat, where older individuals can age gracefully in unity with nature, blessed with soothing weather and pollution-free environment throughout the year, he said. It has been designed by US-based architects, Perkins Eastman, Somji said. The first phase, comprising 6 buildings and 248 apartments, will be completed in 30 months. The pricing of these apartments starts at Rs 35 lakh which includes 15 years of maintenance, said Santosh Naik, MD and CEO of Disha Direct, which has conceptualised and marketed the project. The complex will have medical facilities with ICU, 24- hour ambulance service, routine check-up facility, physiotherapist on call and trained staff in all health departments, he said.

INDIA'S TAX RATES HIGHEST AMONG WORLD

Tax rates for companies in

India are among the highest in the world and the number of payments is also

more than the global average, putting the country at a low 158th rank on the

'Paying Taxes 2014' list. However, the time taken for tax payments is

relatively less in India, which is rated ahead of China and Japan where it

takes 318 hours and 330 hours, respectively, to comply with tax regulations,

according to a World Bank and PwC report. According to the report, the total

tax rate in India can be as high as 62.8 per cent, there are as many as 33

payments under the head of profit, labour and other taxes, and the time taken

to comply with taxation requirements could be as much as 243 hours. On a global

average, a company takes 268 hours to pay taxes, makes 26.7 payments and has a

total tax rate of 43.1 per cent. India was placed 158th position in the overall

ranking of paying taxes, above Brazil (159th) and below the Russian Federation

(56th) and China, which was ranked 120th. The United Arab Emirates was in first

place, followed by Qatar and Saudi Arabia in second and third positions in the

overall ranking. The report noted that in South Asia, India is the only economy

(of eight) with a complete online system for fling and paying taxes. In the

Asia Pacific region, in the past year, the Maldives and Sri Lanka have

introduced online platforms for filing and paying labour contributions, easing

the administrative burden of complying with labour regulations, the report

noted. Over the past nine years, China registered the largest drop in the

number of tax heads, with a fall of 28 payments, followed by India and

Malaysia, which each reduced payments by 22. The most common reason for the

reduction in the number of payments is the introduction and improvement of

electronic filing systems along with their adoption by taxpayers, the report

said. Paying Taxes 2014 investigates and compares tax regimes across 189

economies worldwide, ranking them according to the relative ease of paying

taxes. The period covered by the study was 2004 to 2012.

MUMBAI PROPERTY PRICES ON CORRECTION PATH

Weak absorption and rising

inventories in the residential market here may lead to price correction in the

early part of 2014, real estate consultancy firm Knight Frank said today.

Nearly 2.9 lakh residential units are under construction in the city while

unsold units stood at 1.3 lakh during the January-September period, Knight

Frank said in a report.

"The weakening real estate prices suggest that long- standing stalemate between buyers and builders is finally turning in the buyers' favour. The increase in inventories coupled with weakening absorption levels would put further pressure on prices," its research director Samantak Das said. Mumbai's unsold inventory level is almost 44 per cent in comparison to NCR's which stands at 26 per cent even with twice the number of units under construction, the report said.

Owing to weakening demand, new launches in the city plummeted over 40 per cent compared to peak levels in 2010 as developers shift focus on liquidating current inventories.

As many as 47,488 residential units were launched during January-September.

"The residential market has been witnessing a steep decline in new launches as well as demandj....Unsold inventory pressure in Mumbai is the highest among all other cities and is depicting a growing trend. We expect a more pronounced price correction which may drive the market to a better equilibrium," he said. The current environment will put pressure on prices in the medium term and the scenario is expected to last till the forthcoming general elections. Further, the rise in interest cost and decline in net profit in 2013 will compel developers to lighten load and de-leverage their balance sheets.

"Major listed companies have defaulted their loans this year, which depicts significant stress levels on their balance sheets. Developers are now trying to salvage the situation by limiting fresh launches and boost sales by promotional activities to avoid reducing the base price.

"Overall, the right time for buyers to expect good deals in the market," company's national director Mudassir Zaidi said.

"The weakening real estate prices suggest that long- standing stalemate between buyers and builders is finally turning in the buyers' favour. The increase in inventories coupled with weakening absorption levels would put further pressure on prices," its research director Samantak Das said. Mumbai's unsold inventory level is almost 44 per cent in comparison to NCR's which stands at 26 per cent even with twice the number of units under construction, the report said.

Owing to weakening demand, new launches in the city plummeted over 40 per cent compared to peak levels in 2010 as developers shift focus on liquidating current inventories.

As many as 47,488 residential units were launched during January-September.

"The residential market has been witnessing a steep decline in new launches as well as demandj....Unsold inventory pressure in Mumbai is the highest among all other cities and is depicting a growing trend. We expect a more pronounced price correction which may drive the market to a better equilibrium," he said. The current environment will put pressure on prices in the medium term and the scenario is expected to last till the forthcoming general elections. Further, the rise in interest cost and decline in net profit in 2013 will compel developers to lighten load and de-leverage their balance sheets.

"Major listed companies have defaulted their loans this year, which depicts significant stress levels on their balance sheets. Developers are now trying to salvage the situation by limiting fresh launches and boost sales by promotional activities to avoid reducing the base price.

"Overall, the right time for buyers to expect good deals in the market," company's national director Mudassir Zaidi said.

ADOPT AADHAAR TO CARD BASED TRANSACTIONS

In order to ensure security

in card- based payment transactions taking place at point of sale (POS)

terminals or at ATMs, the Reserve Bank today advised banks that they may adopt

Aadhaar as additional authentication or move to EMV chip and pin technology.

"In respect of cards, not specifically mandated by the RBI to adopt EMV

norms, banks may take a decision whether they should adopt Aadhaar as

additional factor of authentication or move to EMV chip and Pin technology for

securing the card present payment infrastructure," RBI said in a

notification. However, it said all new card present infrastructure has to be

enabled with both EMV (Euro pay MasterCard Visa) chip and Pin technology and

Aadhaar acceptance. Biometric (finger print/retina scan) captured by UIDAI can

be used as authentication to protect against both domestic counterfeit and lost

& stolen card fraud as the cardholder has to be physically present at the

POS terminal/ATM to authenticate the transaction. Even if the card is

counterfeited, the fraudster will not be able to use the card as biometric of

the customer would be required. For securing card and electronic payment

transactions, RBI had set up a working group that had recommended evaluation of

UIDAI's Aadhaar as an effective alternative for additional factor of

authentication for domestic transactions. RBI said the recommendations of the

Working Group have been examined and these have been advised after taking into

consideration the developments that have taken place in the card payment

ecosystem as well as the scalability and effectiveness of Aadhaar over a period

of time. Card present transactions at POS or at ATMs constitute the major

proportion of card based transactions in the country. Currently, transactions

using cards at POS do not require additional authentication in majority of the

cards. However, data stored in magnetic stripe is vulnerable to skimming.

Increasing confidence of the customer for using POS channel would require

securing of these transactions through implementation of authentication in the

short run and prevent counterfeiting of cards by migrating to chip and PIN in

the long run. EMV chip card protects against counterfeit (skimming) card fraud.

EMV chip card and PIN protects against both counterfeit (skimming) and lost

& stolen card fraud.

NIFTY OUTLOOK FOR 27th NOVEMBER & REVIEW OF 26th

FORENOON/MID SESSION BETTER

Nifty lost about 1% and appears to have corrected for Monday’s

huge rise. However, Nifty needs to sustain above 6020 to maintain the momentum

and in case it does, it can go upto 6150 in the coming Two sessions. On the

other hand, if it goes below 6020, it could slip further and make a new low

before expiry. Nifty spot is expected to

encounter resistance at 6100, 6135 and find support at 6020, 5985 for Wednesday.

While Global cues and Funds flow are expected to broadly guide the market

movement, based on the present market position, market is expected to display

zigzag movements with better forenoon / midsession and might experience profit

booking towards close.

Nifty

Review for Tuesday, 26th

November, 2013 :: Correction for Monday’s Huge Rise ..!!

Market

opened subdued and

generally traded with bearish bias and closed with a loss of about 1%

and about 50% of Monday’s rise is evaporated. 37 of Nifty stocks closed

in the red and broader market too was negative with Advance Decline

ratio placed at 1:1.6.

Barring Auto index, all other sectoral indices closed in the red led by

Media,

Bank Nifty, Energy, Realty, FMCG, Metal. Lupin, BHEL, SSLt, Hind

Unilever, Hero Motors remained gainers among Nifty stocks while BPCL,

Bank of

Baroda, NMDC, ICICI Bank, and Cairn remained major losers among Nifty

stocks.

Among F&O stocks,

UBL, PTC, MRF, Aurobindo, Yes Bank remained

gainers while BPCL, Unitech,

Adani Enterprises, Canara Bank, HPCL

remained major losers.

Inputs provided by

Dr.Bhuvanagiri Amaranatha Sastry

Astro Technical Analyst

Saketha Consultants, Hyderabad

He can be reached @sastry.saaketa@gmail.com

09848014561

Sensex slips 180 points

The benchmark Sensex slid

180 points today as crude oil prices recovered and investors booked profits in

banking, PSU and oil & gas sector stocks. The absence of fresh triggers and

cautious sentiment before the expiry of monthly derivative contracts on

Thursday and the release of GDP data on Friday also weighed on sentiment,

traders said. ICICI Bank, ITC, HDFC and Reliance Industries dragged the Sensex

lower. Bharti Airtel and Coal India were among the biggest losers on the index.

The 30-share S&P BSE Sensex resumed steady at 20,604.27 and then declined

to 20,390.62. It ended at 20,425.02, down 180.06 points or 0.87 per cent. The

CNX Nifty on the National Stock Exchange fell 56.25 points, or 0.92 per cent,

to end at 6,059.10.

Monday, November 25, 2013

AIRLINES OFFER HEAVY DISCOUNTS

Ahead of the busy holiday

season, Southeast Asian airlines have started wooing Indian travellers with

promotional offers and discounts, with three of them announcing their schemes

today. While Kuala Lumpur-based airline AirAsia offered to sell three million

seats across various destinations at low fares, Singapore Airlines and its

subsidiary SilkAir announced up to 12.5 per cent discount on First and Business

Class travel from India to Singapore or Australia. But all these offers come

with certain riders.

As part of its fifth anniversary celebrations, AirAsia said passengers would be able to travel from May 5, 2014 to January 31, 2015 under the "free seats" campaign. The bookings for promotional seats with Rs 500 base fare and applicable taxes and fee for a oneway ticket which were available till December one, AirAsia said in a statement.

A Singapore Airlines statement said air travellers could enjoy up to 12.5 per cent discount on First and Business Class with tickets on sale till December 21. Travel would be valid for travel from Dec 1-31 this year only. Transit passengers to Australia could also collect a complimentary 40 Changi Dollar Voucher at Singapore's Changi Airport for use at all participating shops, restaurants and lounges.

NIFTY OUTLOOK FOR 25th NOVEMBER & REVIEW OF 24th NOVEMBER

MID SESSION BETTER

Nifty gained about 2% on the first day of the week and

appears to have reversed the 3 week losing momentum. However, it should not go

below 6000 mark and close above Monday’s high level to confirm the strength. Nifty

spot is expected to encounter resistance at 6150, 6185 and find support at 6075,

6040 for Tuesday. While Global cues and

Funds flow are expected to

broadly guide the market movement, based on the present market position, market

is expected to display zigzag movements with better midsession and might

experience profit booking in the closing Session.

Nifty

Review for Monday, 25th

November, 2013 :: Huge Rally ..!!

Market opened better and rallied further after a pause in

the afternoon and closed with a gain of about 2% and Nifty closed above 6100

mark. 46 of Nifty stocks closed in the green and broader market too is positive

with Advance Decline ratio placed at 2.2 : 1. Bank Nifty, Realty, Infra, FMCG, Auto indices

remained major gainers while IT index closer with minor loss. BHEL, ICICI Bank,

BPCL, Kotak, SBI stood out as major gainers among Nifty stocks while NTPC,

Infy, Hindalco, Lupin remained losers among Nifty stocks. ICICI Bank, ITC, HDFC Duo and Reliance were

the major contributors for Nifty’s gain.

Among F&O stocks,

Crompton Greaves, Siemens, HPCL, Orient Bank, BHEL remained

gainers while Exide, Arvind,

IDEA, GSK Consumer, Godrej Industries

remained major losers.

Inputs provided by

Dr.Bhuvanagiri Amaranatha Sastry

Astro Technical Analyst

Saketha Consultants, Hyderabad

He can be reached @sastry.saaketa@gmail.com

09848014561

SENSEX SURGES 388 POINTS

The benchmark Sensex surged

388 points to post the second-biggest gain among Asian stock indices today as

crude oil prices fell after Iran agreed to curb its nuclear programme to get

relief from sanctions. State-owned refiners, which benefit from cheaper oil,

advanced and the BSE Oil & Gas sectoral index rose 1.73 per cent. Capital

goods, bank and realty stocks led 12 of the 13 sectoral indices higher. BHEL

and ICICI Bank were the biggest of the 27 gainers on the 30-share Sensex, which

snapped three days of losses and helped investors gain Rs 1 lakh crore. The

S&P BSE Sensex, opened on a strong note and stayed firm through the day. It

shot up 387.69 points, or 1.92 per cent to end at 20,605.08 -- close to the

day's highs. Benchmark WTI and Brent crude oil prices fell after Iran agreed to

limit its nuclear programme to get some relief from sanctions, raising the

possibility that curbs on its oil exports would soon be lifted. Lower crude

prices would help ease inflation in India, which imports about 80 per cent of

its crude oil requirements. The CNX Nifty rose 2 per cent, advancing the most

among Asian stock indices, and climbed 119.90 points to 6,115.35. State-owned

oil refiners Hindustan Petroleum surged 6 per cent, Bharat Petroleum added 4.45

per cent and Indian Oil advanced 2.52 per cent. State-run explorer ONGC rose

3.7 per cent on prospects that lower oil prices would ease its fuel subsidy

burden. The markets may remain volatile over the next few days on alternate

bouts of buying and selling due to the expiry of derivative contracts on

November 28. Barring China and Hong Kong, Asian stocks closed with gains on the

Iran agreement.

Sunday, November 24, 2013

ICONIC PROPERTIES IN MUMBAI ON HIGH DEMAND

Prime properties are still fetching good

vale in this land-starved megapolis even as rentals are seem to be

falling, going by the the recent trend of landmark buildings changing

hands, experts have said. The landmark Cadbury House in the tony

southern part of the city has already changed hands. The one which is

believed to be on the block is the past headquarters of Citigroup India

at the Badra-Kurla Complex (BKC) area. According to sources, the

8-storeyed Citi Centre us up for sale. Citi could not be reached for

comments. Private equity firm Blackstone and Pune-based Panchshil

Realty are said to be in discussions to buy majority stake in the iconic

Express Towers in Mumbai in a big-ticket deal. "Some of the deals are

happening where there is land parcel as in the case of Cadbury. These

land parcels are mainly used for redevelopment purposes. In the case of

Cadbury, the buyer plans a mixed-use development which will have two

towers with one only dedicated for residential. There are many such

deals in the pipeline," Knight Frank Executive Director Rajeev Bairathi

told PTI. At the same time, Air India Towers, another equally iconic

landmark, has been trying to lease out most of its 22 floors but with

little success. TCS, SBI and just launched Mahila Bank are the only big

tenants there. Also rentals in the Nariman Point area have been falling

steadily as new CBDs—BKC, Lower Parel among others come up. In the

last two years alone rentals have crashed over 20 per cent, experts

said. The Cadbury Houses was snapped up by the diamond merchant

Dilipkumar Lakhi, who beat top builders to emerge as the highest bidder

for the property owned by confectionery major Mondelez International,

the owners of Cadbury brand. With an office area of over 36,000 sqft,

the Cadbury House has been the headquarters for over 50 years. When

asked for the reasons for spike in demand for iconic properties, PwC

Associate Director Bhairav Dalal told PTI that there is huge investor

interest in buying stabilised and high-yeilding assets which are

available in the city. Investors are interested in properties which are

leased out and have good track record, he said, adding that these

properties are generally iconic ones. "We expect to see such deals

happening in the near future as well." The trend is not just in south

Mumbai but happening even in the suburbs like Powai or even in Thane,

where sellers want to monetise the non-core/non-productive assets, said

PwC Executive Director Shashank Jain. According to a CB Richard Ellis

report, the quarter saw only about 0.1 million sqft being sold in

Bandra-Kurla Complex against 0.16 million sq ft in the June quarter. In

the September quarter, the city saw a steep 50 per cent sequential fall

in large commercial space leasing. In the March quarter, the fall was

steeper at 62 per cent, according industry data.

INVESTORS WEALTH DOWN BY 3.45 LAKHS

Investor wealth has eroded by over Rs 3.45

lakh crore to Rs 66.39 lakh crore so far this year, even though the

stock market benchmark index, Sensex, has made gains during this period.

Despite headwinds including the depreciating rupee, concerns over the

US Federal Reserve's winding down its USD 85-billion a month bond buying

programme and geo-political concerns, the BSE 30-stock index has risen

by 3.25 per cent to 20,217.39 points as on November 22. From a 52-week

low of 17,448.71 on August 28, the Sensex has risen 2,768.68 points or

15.86 per cent. However, from a record high of 21,321.53 on November 3,

the index has lost 1,104.14 points or 5.17 per cent.

Overseas investors have been bullish on the Indian stock market as their total investment has reached Rs 96,461 crore (USD 17.4 billion) so far in 2013, as per data by market regulator Securities and Exchange Board of India.

Despite all this, the total investor wealth slumped Rs 3,45,864 crore to Rs 66,39,136 crore in 2013.

Market analysts said that fist few months were tough for the Indian stock market amid political uncertainty after DMK pulled out of the ruling UPA coalition, debt crisis in the euro-zone nations pertaining to Cyprus bailout and weakness in the value of rupee.

The rupee had touched a record low of 68.85 against the US dollar on August 28. Currently, the domestic currency is trading at 62.87.

"Market is very highly dependent on foreign investors' behaviour. So, if that is the situation then clearly whatever happens with the tapering and FII flow, it remains (linked to) that. That would be one of the determining things and we will be dependent on that," said Raamdeo Agrawal, Joint MD, Motilal Oswal Financial Services.

However, he added that at this juncture markets are not over-valued and things are healthy as good companies are getting traction.

"There is lot of liking for midcaps and actually we are seeing fresh funds being raised for midcaps. So there is some hope coming back but still I would hope that domestic investors come back to the market," Agarwal said.

Markets lost momentum after minutes from the US Fed's last meeting signalled that the easy money policy may be rolled back in the coming months as the world's largest economy shows signs of recovery. The US central bank's bond-buying plan has been a source of liquidity for most Asian and emerging markets, including India, this year.

In 2012, investor wealth had surged 27 per cent to around Rs 67.7 lakh crore. FII investment in the country's equity market had reached Rs 1,27,455 crore (USD 24 billion) and the Sensex had gained about 25 per cent, even though the Indian economy faced signs of slowdown.

Overseas investors have been bullish on the Indian stock market as their total investment has reached Rs 96,461 crore (USD 17.4 billion) so far in 2013, as per data by market regulator Securities and Exchange Board of India.

Despite all this, the total investor wealth slumped Rs 3,45,864 crore to Rs 66,39,136 crore in 2013.

Market analysts said that fist few months were tough for the Indian stock market amid political uncertainty after DMK pulled out of the ruling UPA coalition, debt crisis in the euro-zone nations pertaining to Cyprus bailout and weakness in the value of rupee.

The rupee had touched a record low of 68.85 against the US dollar on August 28. Currently, the domestic currency is trading at 62.87.

"Market is very highly dependent on foreign investors' behaviour. So, if that is the situation then clearly whatever happens with the tapering and FII flow, it remains (linked to) that. That would be one of the determining things and we will be dependent on that," said Raamdeo Agrawal, Joint MD, Motilal Oswal Financial Services.

However, he added that at this juncture markets are not over-valued and things are healthy as good companies are getting traction.

"There is lot of liking for midcaps and actually we are seeing fresh funds being raised for midcaps. So there is some hope coming back but still I would hope that domestic investors come back to the market," Agarwal said.

Markets lost momentum after minutes from the US Fed's last meeting signalled that the easy money policy may be rolled back in the coming months as the world's largest economy shows signs of recovery. The US central bank's bond-buying plan has been a source of liquidity for most Asian and emerging markets, including India, this year.

In 2012, investor wealth had surged 27 per cent to around Rs 67.7 lakh crore. FII investment in the country's equity market had reached Rs 1,27,455 crore (USD 24 billion) and the Sensex had gained about 25 per cent, even though the Indian economy faced signs of slowdown.

Saturday, November 23, 2013

OUTLOOK FOR WEEK AHEAD

Pullback

on Cards… !!

Planetary Position :: During the current week Moon would be

transiting from Makha in Leo to Hastha in Virgo . Sun transits in Anuradha constellation in Scorpio. Mercury, transits in Visakha constellation in Libra. Mars transits in Uttara constellation in Leo and Virgo. Saturn continues in Visakha constellation in Aries navamsa. Jupiter transits in Retrograde motion (till 6th March 2014) in Gemini in Taurus Navamsa . Venus transits in Poorvashadha constellation in Sagittarius sign. Positive feature of the week is Sun Trine Uranus which can lift up the sentiment suddenly leading to Pullback. 26th November is a sensitive and turning day during the week.

Nifty

Outlook for Next Week :: 25.11.2013 to 29.11.2013 (Relief Rally)…

NIFTY

:: 5995 (-61)

Nifty

continued its downtrend for the Third Week and weekly loss was possible only because

of huge fall in Second half of the week due to global cues. As expected in last

week’s column previous low was revisited and a slightly lower low was formed

during the week. Technically, a minor relief rally is possible by end of the

week which if happens can be gauged whether it would convert into a major one

or not. As F&O expiry is also due on Thursday, scrip specific action is to

be expected and bearirsh scrips could drift down further. However, in view of

the fall for Three weeks, a rebound too is possible. Hence caution is advised

at lower levels not to entertain fresh shorts without proper risk management. Ongoing correction can be considered as a

healthy correction for the smart rise of last month. While Short term trend is

Down, Medium / Long term trend continues to be Up . and any decent correction

is to be utilized for Medium term long

positions. However, global cues such as Fed tapering, FII inflows are the major

trigger fro our market movement. Political developments are to be closely

watched for further trigger. Further, Nifty has been trading in a range of 4600

to 6300 for more than 4 years and is due for a powerful breakout sooner

than later. All eyes are on forth coming State Elections which could be viewed

as a prelude for the forthcoming Big fight. Stock market discounts future

in advance and is ahead of economy and fundamentals atleast by Six months. and

medium term bullish sign in markets presupposes improving fundamentals as is

evidenced by market reports that earnings are improving. Nifty has been

making higher bottoms and can be expected to breakout and make higher tops.

“Buy on Decline” may be followed for Medium / long term. Traders should be ever

vigilant to track short term movements and presently, a close above 6100 only

would reverse the short term bearish sentiment. Nifty is above

200 DMA and 50 DMA and the 50DMa also has crossed 200DMA and makes a clear case of “Buy on

Decline” with 200 DMA as stop loss. .

For the coming week, Nifty spot is expected to face resistance at

6075, 6150, 6230 and find support at 5915, 5840, 5765.

Nifty , presently in short term bearishness, would reverse only on a close above 6100.

Advice

for Traders :: Nifty , presently, in short term bearishness, can be expected to

take support at lower levels and might rebound during the week, particularly

second half of the week. Further, in view of F&O expiry, scrip specific

action can be expected and Bearish scrips might drift down further. Technically,

short term bearishness would end on a close above 6100.

WD Gann’s

natural numbers which would act as natural support and resistance are

, 5815,:5891, 5968, 6046, 6124, 6202 ,6281, 6361 during the week.

natural numbers which would act as natural support and resistance are

, 5815,:5891, 5968, 6046, 6124, 6202 ,6281, 6361 during the week.

Inputs provided by

Dr.Bhuvanagiri Amaranatha Sastry

Astro Technical Analyst

Saketha Consultants, Hyderabad

MARKET MAY BE VOLATILE

Stock markets may remain volatile this week

as investors churn portfolios ahead of the monthly derivatives contract

expiry on Thursday and announcement of second quarter economic growth

data on Friday, experts said. In the absence of any major trigger,

domestic markets are also expected to take cues from international

developments such as hints on the timing of US stimulus tapering, they

said, adding that foreign fund flows would also be closely watched.

"Global cues, political and economic news within the country shall be

deciding market trend in near-term. This week 5,970 shall be crucial

deciding level for Nifty in near-term and the index is likely to witness

further selling below this level," said Nidhi Saraswat, senior research

analyst, Bonanza Portfolio Ltd. The overall GDP growth in India is

expected to have risen by around 4.5 per cent during the second quarter

of this financial year. This is marginally higher higher than the 4.4

per cent economic growth registered in April-June quarter. Renewed

uncertainty about the US Federal Reserve tapering its stimulus programme

and the absence of buying by foreign institutional investors had

weighed on the market last week. The 30-share Sensex closed at 20,217.39

on Friday while Nifty ended at 5,995.45. "International markets have

been flat in the last one week after moving up on Yellen's statement of

delay in tapering. Indian markets had also moved up sharply a week ago

hence, they have given a mild correction," said Rajesh Iyer, Head,

Investments and Family Office, Kotak Wealth Management. He further

added that equity markets will react to international news flow and

results of upcoming state polls. "Earnings downgrade cycles seems to be

bottoming out and sentiment is turning positive but macros are still

supporting. Except for Current Account Deficit, all other macro

parameters are still challenging and would take time to recover," Iyer

said. Elections will be held in Madhya Pradesh on Monday. Registering

its third weekly loss, the Sensex, fell 0.9 per cent over the last week.

Analysts have also raised concerns over low retail participation and

hoped they return soon. "Retail participation will return after 2014

elections if a decisive government is elected at the Centre. People are

tired of weak execution of policies, and once that is addressed by a

decisive government, stock market will witness return of domestic

investors," said Raamdeo Agrawal, Joint MD, Motilal Oswal Financial

Services.

Friday, November 22, 2013

DIABETIC STRIPS TO COST LESS

There is some good news for all those who

need to check blood sugar levels regularly, as glucose test strips may

be available for less than Rs 5 by year-end. With prototypes of

such blood glucose test strips, which now cost between Rs 30 to Rs 35,

being developed by various organisations across the country with the

help of Indian Council for Medical Research (ICMR), the economical

version is likely to be made available by the end of December.

Secretary Health Research and Director General of ICMR V M Katoch said, "these strips will be made available by the end of this year".He said, "The cost of such strips will drastically come down as ICMR has provided public and private organisations with its research technology. This will help bring the cost of such strips between Rs 3 to Rs 5."

Currently, such strips are available in the market for over Rs 30-35 and patients suffering from diabetes have to use the expensive kits extensively.

These glucose testing strips can also be used for screening of diabetes as well as for self regulation of sugar levels among those suffering from diabetes. The country's cheapest strips are being developed by institutes like BITS Hyderabad, IIT Kharagpur, CMC Vellore and others and are part of ICMR's long-term sustained Indian solutions to help bring down the cost of equipment for the common public. The step assumes significance as India is the diabetes capital with the country set to cross the diabetes burden of 100 million by the year 2030.

According to recent data, experts say the country has witnessed a 12 per cent increase in the number of diabetes cases to 61 million in 2012 as against 50.8 million in 2011. Diabetes is also a major reason for deaths in the country.

"These strips are aimed to provide 95 per cent accuracy, as with the currently available strips in the market and they will help largely in screening for diabetes," said S K Rao, Joint Secretary in the Ministry of Health and Family Welfare.Katoch said different prototypes for such strips are being developed and tested currently before their formal launch in the market. These include strips that are used with glucometers, besides those which can be used even without the use of glucometer and will have callibrations on them. A different prototype is being developed for testing sugar levels through the saliva.

Secretary Health Research and Director General of ICMR V M Katoch said, "these strips will be made available by the end of this year".He said, "The cost of such strips will drastically come down as ICMR has provided public and private organisations with its research technology. This will help bring the cost of such strips between Rs 3 to Rs 5."

Currently, such strips are available in the market for over Rs 30-35 and patients suffering from diabetes have to use the expensive kits extensively.

These glucose testing strips can also be used for screening of diabetes as well as for self regulation of sugar levels among those suffering from diabetes. The country's cheapest strips are being developed by institutes like BITS Hyderabad, IIT Kharagpur, CMC Vellore and others and are part of ICMR's long-term sustained Indian solutions to help bring down the cost of equipment for the common public. The step assumes significance as India is the diabetes capital with the country set to cross the diabetes burden of 100 million by the year 2030.

According to recent data, experts say the country has witnessed a 12 per cent increase in the number of diabetes cases to 61 million in 2012 as against 50.8 million in 2011. Diabetes is also a major reason for deaths in the country.

"These strips are aimed to provide 95 per cent accuracy, as with the currently available strips in the market and they will help largely in screening for diabetes," said S K Rao, Joint Secretary in the Ministry of Health and Family Welfare.Katoch said different prototypes for such strips are being developed and tested currently before their formal launch in the market. These include strips that are used with glucometers, besides those which can be used even without the use of glucometer and will have callibrations on them. A different prototype is being developed for testing sugar levels through the saliva.

ASIA'S 1st CONTENT MARKETING SUMMIT IN JAN

Asia's 1st Content Marketing

Summit CMS Asia 2014 is to be Held at New Delhi on 31st Jan and 1st Feb 2014 In

a first-of-its-kind event in this part of the world, Content Marketing Summit

Asia 2014, aims to bring some of the greatest minds, savvy brands, renowned publishers,

innovative technology enablers and leading practitioners from across the world

come together to explore the exciting world of content marketing. (Logo:

http://photos.prnewswire.com/prnh/20131122/10081474) Content Marketing Summit

is backed by Singapore-based Asia Content Marketing Association (ACMA). The

summit's advisory board includes top executives from big names like Adobe,

GroupM, Yahoo, Godfrey Philips India, Chicco India, The 120 Media Collective,

HMH Publishing and Sirez Group among others. Umang Bedi, Managing Director -

South Asia, Adobe & Advisory Board Member of CMS Asia comments, "If

content is at the heart of what you do, you must recognize the importance of

marketing it right. The playing field for marketers has not only widened

tremendously, but is changing and evolving. There is no standard playbook to

ensure success because content marketing is both a science and an art. A

platform like CMS Asia will give you the opportunity to not only understand the

science behind content marketing, but also listen to and interact with industry

experts and see the art behind it." CMS Asia is aimed at spreading

knowledge about content marketing. While Day 1 of the summit will have renowned

speakers from across the world share their knowledge, ideas, and experiences;

Day 2 is reserved for workshops.

"Most conferences and

summits stop at enlightening. But with CMS Asia, we want that enlightenment or

wisdom gained to translate into action. A day dedicated to practical workshops

is all about that. We at ACMA (Asia Content Marketing Association) are excited

about this, as it's a much-needed initiative in this part of the world,"

says Vaasu Gavarasana, Co-founder of ACMA & APAC Business Head of Yahoo.

The motto of Content Marketing Summit Asia is succinctly summed up in three

words: Share - Knowledge and ideas by thought leaders and practitioners Connect

- Marketers, publishers, content creators and technology enablers Act -

Translate learning into actionable steps through workshops According to the

brains behind the summit, it's time brand marketers, publishing firms and

content creators step out of their cocoons, come together, and find ways to

work with each other and leverage each other's strengths. "While the

discipline of content marketing itself isn't anything new, the rapid expansion

of digital media and the growing clout of social media have altered Content

Marketing in unexpected ways. This metamorphosis presents exciting new

opportunities for brands, publishers, agency partners and independent creators

alike," says Vijay Simha Vellanki, Co-Founder of Kontent Café, the

organization behind CMS Asia. CMS Asia 2014 will attract around 300 delegates

from over 7 countries in Asia, with over 30 speakers from across the globe to

share their experience on Content Marketing.

ACCESS FOR FINANCE STILL FAR AWAY FOR POOR

Sa-Dhan, the association of

community development finance institutions and MFIN, today organized the

'Interface on Financial Inclusion' to bring together women from across the

nation to discuss their experiences with microfinance. With more than 60% of

the country's population outside the reach of the formal banking sector,

financial inclusion and financial literacy that can result in inclusive growth

and human development, has become a crucial mandate. The event saw a vibrant

discussion between women and senior officials from policy making bodies, around

the financial challenges being faced by women in rural areas and the immensely

positive experience they have had with microfinance. Access to finance is still

tough for the poor as they face several problems starting from the attitude of

a banker towards the poor, opening an account, collateral need and cumbersome

paper work for getting a loan, distance from the bank branch, indefinite number

of visits, transportation cost, wage loss etc. To address these problems,

microfinance sector has stepped up as a viable financing option for the poor by

providing last mile connectivity for banking services. Shri Jagadananda,

Chairman, Sa-Dhan said, "There is no shortage of pro-poor options,

policies, schemes or institutions in the country, the challenge is achieving

last mile connectivity. Microfinance is playing a critical role in providing

this last mile linkage in terms of financial services for the poor. The upcoming

MFI Bill, we hope will further streamline the microfinance sector and ensure

smooth functioning."

Mr Mathew Titus, Executive

Director, Sa-Dhan said, "The Interface on Financial Inclusion is an

attempt to bring voices and concerns from the community to a platform that can

directly impact public policy. The demand for financial services for the poor

in terms of savings, pension and insurance, is a robust one but the

institutional structure required has a long way to go." An SHG member from

Bihar, said, "We had a small business which was in trouble. A friend

introduced me to microfinance. Facilities like loans and insurance started

reaching us. This empowered us and helped us become self reliant."

"Everything today requires money - be it business or the education of our

children. Associating with the group and microfinance has encouraged me to

develop my skill and teach it to others so that all of us can progress

together," added another participant. The event took place in New Delhi

and was attended by over 200 women. Also present were, Shri Shivkumar

Chanabassappa Udasi, Hon. Member of Parliament, and representatives from the

Ministry of Finance, NRLM, SIDBI, PFRDA, NABARD, academia and the developmental

finance ecosystem. Sa-Dhan is a common platform for key microfinance

practitioners and community development finance institutions in India. Website:

http://www.sa-dhan.net Micro Finance Institutions Network (MFIN) is an

association of Non-Bank Finance Company Micro Finance Institutions (NBFC-MFIs).

MARKET REVIEW

SENSEX ENDS IN RED FOR THE WEEK

The benchmark Sensex failed

to sustain initial gains today and fell for the third day, dropping 12 points,

amid selling in auto, realty and FMCG sector stocks. Renewed uncertainty about

the US Federal Reserve tapering its stimulus programme and the absence of

buying by foreign institutional investors weighed on the market. The rupee was

mainly flat after closing at 62.93 against the dollar yesterday. It was the

third weekly loss for the Sensex, which was dragged lower by ITC, Tata Motors

and ICICI Bank shares. Support came from HDFC, ONGC and Larsen & Toubro.

Sesa Sterlite and Bajaj Auto were among the biggest losers as 18 of the 30

index shares declined.

The S&P BSE Sensex opened higher and climbed as much as 159 points amid

firm global trends. Selling in the last hour and a half pulled the index down

and it ended at 20,217.39, a fall of 11.66 points or 0.06 per cent. The index

has lost 673 points in the past three days and is at the lowest level since

November 13, when it closed at 20,194.4. Over the past week, it slipped 182

points.The wider CNX Nifty on the National Stock Exchange fell 3.6 points to 5,995.45. The SX40 on the MCX Stock Exchange ended 17.88 points higher at 12,026.16. "Mixed global cues, FII selling on Thursday and overall profit booking at higher levels limited the Nifty's upside," said Nidhi Saraswat, Senior Research Analyst at Bonanza Portfolio Ltd. "Rupee too was trading near 62.88 level against the dollar. A probable slowdown in US stimulus also led to cautious approach." Overseas investors sold shares for the first time since October 3. They offloaded a net Rs 59.80 crore of stocks yesterday, according to provisional data on the stock exchanges.

Barring China, Asian stocks were higher after a firm US market. The Dow Jones Industrial Average closed above the 16K-mark for the first time after better-than-expected jobless claims data.

Monday, November 18, 2013

NOW A MOBILE APP FOR WOMEN SAFETY

In the wake

of concerns being raised on security of women in cities, a researcher on women

issues and a technology entrepreneur have joined hands to launch a mobile

application, Safetipin, which provides safety-related information collected by

users. Safetipin is a map-based mobile phone app, that crowd sources and maps

information about safety in neighbourhood and cities.

The app, which is available to Android and iPhone users, is free to use and is available on the App Store and Google Play. The app was launched today in the national capital, by its co-founders Kalpana Viswanath and Ashish Basu. Speaking at the launch Basu said: "The app gives people a way to engage with their neighbourhood and communities on important issues."

People can interact on safety issues and infrastructure, comment on posts and pictures, Basu, , who is an entrepreneur with interests in education and mobile technologies, added. The app's development was supported by the UK government's Department of International Development, Ford Foundation among others. "We aim to strengthen the work done on safety and mapping by NGOs by providing them with a tool that can help them gather data and analyse public safety," Vishwanathan, who is a is a researcher working on issues of violence against women and safer cities for women, said.

A panel discussion on women safety issues was also held on the occasion of the launch, where NIIT Ltd Chairman Rajendra Pawar stressed on searching for ways on how a community focused technology platform can help individuals and communities to engage. The platform should also aid the government and service providers with better avenues to enhance the efficiency and effectively of their services, which also includes safety and security, he added.

The app, which is available to Android and iPhone users, is free to use and is available on the App Store and Google Play. The app was launched today in the national capital, by its co-founders Kalpana Viswanath and Ashish Basu. Speaking at the launch Basu said: "The app gives people a way to engage with their neighbourhood and communities on important issues."

People can interact on safety issues and infrastructure, comment on posts and pictures, Basu, , who is an entrepreneur with interests in education and mobile technologies, added. The app's development was supported by the UK government's Department of International Development, Ford Foundation among others. "We aim to strengthen the work done on safety and mapping by NGOs by providing them with a tool that can help them gather data and analyse public safety," Vishwanathan, who is a is a researcher working on issues of violence against women and safer cities for women, said.

A panel discussion on women safety issues was also held on the occasion of the launch, where NIIT Ltd Chairman Rajendra Pawar stressed on searching for ways on how a community focused technology platform can help individuals and communities to engage. The platform should also aid the government and service providers with better avenues to enhance the efficiency and effectively of their services, which also includes safety and security, he added.

FB TO PROVIDE FREE MOBILE INFO ON ELECTIONS

Voters can

now get to know about the background of candidates contesting Assembly and Lok

Sabha elections on their mobile phones as Association for Democratic Reforms

(ADR) and Facebook have joined hands to provide the information on candidates

for free. Voters will be able to access election candidates' criminal,

financial, educational, professional information directly on their mobile via

Facebook using USSD technology, a joint statement said. Facebook for USSD is a

technology that helps people access facebook on phones without Internet.

USSD allows text experiences on phones that are richer than SMS and cheaper for the user than mobile Internet. Users have to do is dial *325# from their mobile to access Facebook and select the election menu or directly dial *325*35# to access the election menu for no charge, it added. "Over 82 million Indian citizens access Facebook regularly and an increasing number of users access the platform on mobile. Together with ADR...we hope to make information more readily available to users about the antecedents and performance of political candidates," Facebook India Director of Public Policy Ankhi Das said. Das added the goal is to enable citizens to get involved in issues of governance.

"Voters will be able to know the poll worthiness of candidates - their educational, criminal and financial information - at their fingertips and choose wisely. Simply voting in an uninformed manner is not enough, citizens need to make an informed choice," Association for Democratic Reforms Founder and Trustee Trilochan Sastry said.

USSD allows text experiences on phones that are richer than SMS and cheaper for the user than mobile Internet. Users have to do is dial *325# from their mobile to access Facebook and select the election menu or directly dial *325*35# to access the election menu for no charge, it added. "Over 82 million Indian citizens access Facebook regularly and an increasing number of users access the platform on mobile. Together with ADR...we hope to make information more readily available to users about the antecedents and performance of political candidates," Facebook India Director of Public Policy Ankhi Das said. Das added the goal is to enable citizens to get involved in issues of governance.

"Voters will be able to know the poll worthiness of candidates - their educational, criminal and financial information - at their fingertips and choose wisely. Simply voting in an uninformed manner is not enough, citizens need to make an informed choice," Association for Democratic Reforms Founder and Trustee Trilochan Sastry said.

INFLATION ERODING SAVINGS

Subscribe to:

Comments (Atom)

నిర్మలమ్మ మంత్రం "జనాకర్షణ కాదు...జననాడే ప్రధానం"

ఆ దివారం ఆర్థిక మంత్రి నిర్మలా సీతారామన్ వరుసగా తొమ్మిదో బడ్జెట్ ప్రతిపాదించి చరిత్ర సృష్టించారు. ఈ బడ్జెట్ ఎన్నో విశేషాల సమాహారంగా...

-

fo r April 25, 2019 Closing Subdued Tithi : Chaitra Krishna Saptemi Nakshatra : Poorvashadha Persons born in Mrigasira, ...

-

fo r AUGUST 07 , 2019 Second Half Subdued Tithi : Sravana Sukla Saptami Nakshatra : Swathi Persons born in Krittika, Uttara,...

-

Stock Market created a Sunami on Monday as exit polls predicted NDA Government under Prime Minister Naredra Modi will get another term ...