The first superjumbo Airbus A-380 plane

landed here today from Singapore with Singapore Airlines becoming the

only global carrier to launch commercial flights of the 'big birds' to

India. The landing of the long-haul, wide-body and fully double -decker

aircraft that can carry a total of 471 passengers, at the Indira Gandhi

International Airport was preceded by a thunder storm and high-velocity

winds that led to the diversion of 21 flights to nearby airports. On

landing, the superjumbo was given a 'water-salute' by the fire brigade

at the airport run by the Delhi International Airport Limited (DIAL)

which made special arrangements to handle the large number of passengers

and their baggage. The passengers were welcomed by the SIA staff with

gifts and bouquets. The SIA's aircraft has a total seating capacity of

471 seats with 399 in economy, 60 in business class and 12 first class

suites. Immigration and customs departments had made special

arrangements for handling such a large number of passengers. Major Gulf

carrier Emirates would become the second airline to deploy these Airbus

A-380s from Mumbai in July. Late January, government had cleared the

deck for A-380 operations from Delhi, Mumbai, Hyderabad and Bangalore,

lifting a five-year-old ban. The restriction, which was lifted by the

Civil Aviation Ministry after several years of demands by major foreign

carriers, was imposed in 2008 as the government had then felt these

massive jets would help foreign airlines take away a large chunk of

global traffic which could be detrimental to Indian carriers' interests.

Delhi and Mumbai airports had received DGCA certification and have

made preparations to receive the superjumbos in terms of various

services required to handle the large number of passengers these planes

can carry when they land or take off. "The A-380 has received an

overwhelming response from the Indian travellers. This reiterates our

belief in the Indian market and their aspirations to travel the world

which has been the key factor for Singapore Airlines' growth story in

India," SIA general manager David Lau said in Singapore at the launch of

the A-380 operations to India.

Friday, May 30, 2014

NIFTY OUTLOOK FOR 2nd JUNE & REVIEW

BEARISH BIAS

Nifty closed flat for the day and lost more than 1.75% during the week. Immediate strong support is at 7200 and Resistance at 7350 For short term, buying may be avoided till it closes above 7350 or gets nearer to major psychological support zone of 7000.. While Global cues, Quarterly results and Funds flow are expected to broadly guide the market movement, based on the present market position , market can be expected to be better during midsession and remain subdued towards close.

Nifty

Review for Friday :: Bank Stocks Weak… Flat Close … … !!!

Market traded in a narrow range and closed flat for thd day while

Bank stocks were the clear losers and Pharma, FMCG stocks gained smartly. 25 of

Nifty stocks ended in the red and broader market too was flat with Advance Decline ratio at about 1:1.1. Pharma,

Media, FMCG, Infra dn IT indices gained while Bank Index lost considerably.

Hind Unilever, M&M, NTPC contributed about 40 points to Nifty’s gain while

HDFC Duo and ICICI Bank dragged down by about 30 points.

Hind Unileer, NTPC, M&M, Sun Pharma , Cipla remained major gainers among Nifty stocks while Bank of Baroda,

BPCL, Power Grid, SBI and HDFC

remained losers.

Adani Ports, Hind Unilever, Adani Enterprises, Tata

Communication remained major gainers

among F&O stocks while REC, PFC, Bank of Baroda, Orient Bank,

Allahabad Bank declined among F&O

stocks.

SENSEX RECORDS WORST WEEKLY FALL IN 4 MONTHS

The benchmark Sensex today fell 17 points

weighed down by losses in banking shares ahead of GDP data and next

month's RBI policy, logging its worst weekly drop since January 31.

Market sentiment has remained weak as overseas investors have remained

net sellers for the past few sessions and in absence of any positive

trigger, brokers said. Indices, which started the day on a positive

note, turned volatile ahead of the announcement of RBI monetary policy

on June 3. There was also caution ahead of first quarter's Gross

Domestic Product (GDP) data, brokers added. "Investors preferred to

remain on sidelines ahead of GDP data, scheduled to be released later in

the day and RBI policy review next week," said Jayant Manglik,

President-retail distribution, Religare Securities. The BSE 30-share

barometer resumed better and gyrated in a range of 24,353.59 and

24,163.62, before settling at a fresh two-week low of 24,217.34 -- a

loss of 16.81 points or 0.07 per cent. At the day's high, the index was

up over 119 points. On a weekly basis, the Sensex fell 476.09 points.

This was its biggest loss since the week ending January 31, 2014 when it

had weakened by 619.71 points. For the month, the Sensex gained a

whopping 1,800 points -- logging its best monthly performance in recent

times. The 50-scrip NSE index Nifty today ended lower by 5.70 points,

or 0.08 per cent, at 7,229.95. Intra-day, it moved between 7,118.45 and

7,272.50. Banking shares like Bank of India, Canara Bank, Bank of

Baroda, SBI, PNB, HDFC Bank, Indusind Bank, Axis Bank and Federal bank

closed down. Nine out of 12 counters from S&P BSE Bankex finished in

the red ahead of RBI policy on June 3. The Bankex was down by 273.77

points, or 1.59 per cent, and was the second biggest loser among

sectors. The Consumer Durables index was top loser with a fall of 1.78

per cent. Besides, Tata Motors, RIL and TCS also suffered losses.

Shares of HUL, M&M, NTPC, Dr Reddy's Lab, Infosys, ONGC, Bharti

Airtel, Tata Steel, Cipla, Tata Power and Gail, however, ended higher.

Thursday, May 29, 2014

NIFTY OUTLOOK FOR 30th & REVIEW

CLOSING SESSION SUBDUED

Nifty lost more than 90 points to close below 7250, thus breaching the short term support of 7265 and becoming bearish. Derivative closing appears to have precipitated the fall. For short term, buying may be avoided till it closes above 7350. While Global cues, Quarterly results and Funds flow are expected to broadly guide the market movement, based on the present market position , market can be expected to be better during midsession and remain subdued towards close.

Nifty

Review for Thursday :: Bearish Bias … … !!!

After Two days’ of narrow movement, Market traded with clear

bearish bias from the opening and closed with a loss of about 1.40%. 36 of

Nifty stocks ended in the red and broader market too was negative with Advance Decline ratio at about 1:1.4.

Infy lost heavily and was the main reason for the negative sentiment in the

opening session. Media, Pharma, PSU Bank indices gained while IT, Infra, Energy,

Realty, Metal, Bank Nifty indices closed

weak for the day. Infy alone dragged

down Nifty by more than 30 points and Reliance, HDFC Bank and ICICI Bank

contributed another 20 points for the fall.

Hindalco, Dr Reddy, NTPC,, M&M, Sun Pharma remained gainers among Nifty stocks while Infy, Jindal Steel,

Ambuja Cement, HCL Tech, IDFC

remained major losers.

UCO Bank, Bank of India, Apollo Tyres, Allahabad Bank remained major gainers

among F&O stocks while Infy, Jain Irrigation, Adani Enterprises,

Tata Global, Crompton Greaves declined

among F&O stocks.

SENSEX LOGS BIGGEST DROP IN 4 MONTHS

The benchmark Sensex today

plunged 322 points, logging its biggest single-day drop in four months, weighed

down by a sharp 8 per cent sell-off in Infosys shares after a key executive

quit, amid expiry of monthly equity derivative contracts. The Sensex resumed

lower at 24,523.13 and continued to lose momentum to touch an intra-day low of

24,206.50. It settled at 24,234.15, down 321.94 points or 1.31 per cent -- its

biggest fall since the 426.11-point crash on January 27. This closing level is

Sensex's lowest since 24,298.02 on May 21. It had ended higher by 6.58 points

yesterday. The 50-share NSE index Nifty dipped below 7,300 mark by falling

94.00 points, or 1.28 per cent, to close at 7,235.65 after shuttling between

7,325.40 and 7,224.40 intra-day. It was bad session for IT stocks led by

Infosys. The Bangalore-headquartered giant ended 7.81 per cent lower to end below

the crucial Rs 3,000 mark for the first time since mid-September 2013 after

board member and President B G Srinivas, who was considered among the top

contenders for the first non-founder CEO post, resigned from the company. Wipro

fell by 2.63 per cent and HCL Tech, which is not a Sensex entity, slid 2.5 per

cent. However, TCS rose. Besides, expiry of May month series in the derivative

contracts and persistent foreign capital outflows coupled with mixed global

cues also affected the market sentiment, pulling down the benchmark indices.

Tepid earnings from some bluechips also dashed hopes, say traders. There was

also continued profit-booking in recent outperformers such as power, oil and

gas, capital goods, banking, PSUs, realty and consumer durable stocks, they

added. Out of the 30-share Sensex, 22 stocks closed with losses led by Infosys,

the third most influential on the barometer. Oil refinery major Reliance

Industries fell 1.42 per cent after CAG pulled up the firm for charging a rate

in excess of the government approved price for its KG-D6 gas field. Sectorally,

the BSE IT sector index suffered the most by falling 3.44 per cent, followed by

Tech index (2.92 per cent), Oil and gas index (1.64 per cent). Overall, 11 of

12 indices fell while BSE Healthcare index rose.

Wednesday, May 28, 2014

WEB PORTAL FOR FARMERS

Leveraging information technology to provide

latest agriculture-related information to farmers, Gujarat government

today launched a dedicated web portal and related mobile applications

for them. 'iKisan' portal and the related apps were launched by Chief

Minister Anandi Patel at the inauguration of 'Krishi Mahotsav'

(agriculture fair) at Morbi, about 200km from here. She also announced

on the occasion that women will be given more powers to run milk

producing co-operative societies in the state. The portal and apps are

designed to provide important information related to agriculture loans,

new farming techniques, machinery, market prices of produces, soil

testing and availability of seeds, pesticides and fertilisers. This is

the 10th edition of the Mahotsav, a government-organised event.

GOOGLE TO LAUNCH SELF DRIVING CARS

Google unveiled plans to build its own

self-driving car that it hopes to begin testing in the coming months.

"They won't have a steering wheel, accelerator pedal, or brake pedal...

because they don't need them. Our software and sensors do all the work,"

Google's Chris Urmson said in a blog post. Urmson said Google plans

to build about 100 prototype vehicles, "and later this summer, our

safety drivers will start testing early versions of these vehicles that

have manual controls." He added, "If all goes well, we'd like to run a

small pilot program here in California in the next couple of years."

For Google, the car marks a shift away from adapting vehicles made by

others in its quest to pioneer individual transport that needs only a

stop-and-go function. "It was inspiring to start with a blank sheet of

paper and ask, 'What should be different about this kind of vehicle?'"

the post said. The top speed of the battery-powered prototypes will be

40 kilometres per hour and are designed for utility, not luxury. "We're

light on creature comforts, but we'll have two seats (with seatbelts), a

space for passengers' belongings, buttons to start and stop, and a

screen that shows the route -- and that's about it," Urmson said. The

blog post a photo of a prototype and an artist's rendering -- both

rounded bug-looking vehicles. "We took a look from the ground up of

what a self-driving car would look like," Google co-founder Sergey Brin

said at a conference in Rancho Palos Verdes, California. "The reason

I'm so excited about these prototypes and the self-driving car project

in general is the ability to change the world and the community around

you," Brin added. Until now Google has been re-fitting Lexus and Honda

cars to work as self-driving ones. In an interview, Urmson said the new

Google cars will have numerous safety features learned from the

company's research. "In our car there is no steering wheel so we have

to design really fundamental capabilities," he said. "So we have

effectively two motors and they work so if one of them fails the other

can steer, so the car can always control where it's going, and similar

with brakes." In addition to crash protection for the occupant, the car

has features to avoid pedestrians and other road users.

NIFTY OUTLOOK FOR 29th & REVIEW

WIDE RANGE DAY...SCRIP SPECIFIC MOVEMENTS

After Two days’ of mild correction, Nifty closed with minor gains and continues to hold 7300 level. Stop loss for Nifty may be maintained at 7265 (on close basis). Scrip specific movement can be expected in view of the last day of Derivative settlement. While Global cues, Quarterly results and Funds flow are expected to broadly guide the market movement, based on the present market position , market can be expected to experience zigzag movement with subdued midsession. Stock specific movements can be expected in view of the last day of the derivative settlement and a wide range too can be expected in view of the narrow movement for the last Two days.

Nifty

Review for Wednesday :: Lackluster Movements… … !!!

Market traded in a very narrow range and closed with minor

gains for the day. 28 of Nifty stocks ended in the green and broader market too

was positive with Advance Decline ratio

at about 2:1. IT, Realty Infra indices gained while Metal, PSU Bank, Auto,

Energy indices closed weak for the day. HDFC Bank, Infy, ICICI Bank contributed about 20 points to Nifty’s gain

while ONGC, M&M, dragged down by more than 10 points.

Ultra Cement, Ambuja Cement, Tata Power, ACC, HCL Tech remained gainers among Nifty stocks while Coal India, ONGC,

Asian Paints, M&M, remained major losers.

PFC, Orient Bank, Ultra Cement, Ambuja Cement, remained major gainers

among F&O stocks while Sail, Dish TV, HPCL, Syndicate Bank, JP Power

declined among F&O stocks.

ANOTHER FLAT CLOSING

Equity benchmarks Sensex and Nifty today

eked out marginal gains in choppy trades on alternate bouts of buying

and selling ahead of the expiry of May derivative contracts tomorrow.

Brokers attributed nearly stable market to rolling over positions in the

futures and options (F&O) segment from May series to June before

the expiry of equity derivatives. IT, Teck and Realty counters

attracted good buying while Metal, Consumer durable and Auto stocks

recorded losses. The BSE 30-share barometer resumed slightly better and

moved erratically in a range of 24,643.33 and 24,488.81 before

finishing at 24,556.09, a rise of 6.58 points or 0.03 per cent.

Yesterday, it had fallen 167.37 points or 0.68 per cent. Smart gains

were seen in the likes of HDFC Bank, Infosys, TCS, ICICI Bank, L&T,

Bharti Airtel, Tata Power, Hero MotoCorp and Wipro. ONGC, Tata Motors,

M&M, GDFC, Coal India, ITC, SBI, Sun Pharma and NTPC, among others,

closed lower. The wide-based 50-issue CNX Nifty of the NSE also edged

up by 11.65 points, or 0.16 per cent, to end at 7,329.65. Jignesh

Chaudhary, Head of Research, Veracity Broking Services said: "Local

indices traded flat as foreign investors extended their selling, as some

of them are booking profit at the higher levels. Also, investors are

being cautious ahead of the expiry of May derivative contracts due

Thursday." Smallcaps outperformed large-caps on buying by retail

investors. The BSE Smallcap index closed up 1.63 per cent. Meanwhile,

foreign institutional investors (FIIs) sold shares worth a net Rs 202.61

crore yesterday as per provisional data from the stock exchanges.

Markets are now looking at RBI's Monetary policy next week and also the

Union Budget in July by the new government, brokers said. Excepting

Singapore, which closed slightly weak, other Asian markets ended with

gains after China reported increase in industrial profits. Indices in

China, Hong Kong, Japan, South Korea and Taiwan closed up in 0.24-0.97

per cent range. European benchmarks were trading flat to positive in

their early morning deals.

FOOD RETAILERS RUN IN LOSSES

Top 10 food retailers, including Reliance

Fresh, Aditya Birla Retail, Wal-Mart India and Bharti Retail, have

registered accumulated losses of over Rs 13,000 crore in the last

fiscal, ratings agency Crisil said today. "Accumulated losses of food

retailers are estimated to have crossed Rs 13,000 crore in the last

fiscal, an analysis by CRISIL Ratings of top 10 food retailers that are

in gestation phase showed," a Crisil statement said. The companies

analysed by Crisil are Max Hypermarket, Hypercity Retail, Aditya Birla

Retail, Metro Cash & Carry India, Trent Hypermarket, Reliance Fresh,

Heritage Fresh, Spencer's Retail, Bharti Retail and Wal-Mart India.

Commenting on the findings, Crisil Ratings President Ramraj Pai said:

"These losses reflect the challenges in the food and grocery retailing

vertical. Compared with other formats, food retailing is a very local

business where optimal supply chains are critical to lower costs." "The

business also has the lowest gross margins in retailing, which leads to

longer gestation periods. Players, therefore, need a lot of time and

investment to perfect the model and positioning and to scale up to

achieve critical mass," he added. Crisil said retailers are re-working

on their operating model to cut down on losses. "Retailers are now

moving away from large-scale expansions. Exits from unprofitable

categories, rightsizing of stores, closure of unviable and

non-performing stores, focused and calibrated expansion and a renewed

focus on private labels are some of the initiatives which the analysed

retailers are undertaking to achieve faster break-even," Crisil Ratings

Director Anuj Sethi said. The ratings agency said these initiatives

will take time and investment to yield results. Crisil believes these

retailers will continue to expand, backed by promoters. "We estimate as

of March 31, 2014, the 10 retailers have invested about Rs 19,000 crore

for store additions and loss funding – through direct equity infusions,

loans from banks and promoters," it added. Crisil said two large

players that have managed to become profitable are Future Value Retail

Ltd (Future Value) and Avenue Supermarts Ltd. "Future Value (formats

include Big Bazaar and Food Bazaar) has had the first-mover advantage.

It expanded in a low-cost environment and attained critical mass before

the real estate boom led to costly lease rentals. Competition from other

organised players was also less then," it said.

Tuesday, May 27, 2014

MODI CONSTITUTES SIT ON BLACK MONEY

Complying with the Supreme Court

directive, the new government on its first day in office today

constituted a special investigative team (SIT) headed by a former

Supreme Court Judge to unearth black money, including in the case of

Hasan Ali. M B Shah, head of the SIT that also comprises another

retired Supreme Court judge Arijit Pasayat as vice-chairman, will be

assisted by the Revenue Secretary, directors of CBI, IB, RAW and ED, the

CBDT Chairman and an RBI deputy governor. The Supreme Court, which

appointed the two judges, had last week granted the government one week

to set up the SIT. The Union Cabinet headed by Prime Minister Narendra

Modi held its first meeting today in which it named the members of the

SIT. "In the first Cabinet of the new government...in the light of the

directions of the SC, we have constituted an SIT for unearthing black

money... This was an important issue for us," Law and Telecom Minister

Ravi Shankar Prasad told reporters after a one-and-a-half-hour Cabinet

meeting. According to a press release, other members of the SIT are

Director General of the Narcotics Control Bureau, Director General of

Revenue Intelligence, Director of the Financial Intelligence Unit and a

Joint Secretary in the Central Board of Direct Taxes. "The SIT has been

charged with the responsibility and duties of investigation, initiation

of proceedings and prosecution in cases of Hasan Ali and other matters

involving unaccounted money," it said. The panel will have jurisdiction

in cases where investigations have commenced, are pending, are waiting

to be initiated or have been completed. Prasad said setting up of the

SIT "indicates the commitment of the new government to pursue the issue

of black money."

Prasad said that earlier, the Supreme Court had given certain orders, but there were some delays. "Tomorrow is the last date (for setting up of SIT), therefore the very first agenda in accordance with its policy commitment was to have this very high-profile SIT," he said. The SIT will also prepare a comprehensive action plan, including creation of an institutional structure that could enable the country to fight the battle against unaccounted money. It should report on the status of its work to the court from time to time, the statement added.

Prasad said that earlier, the Supreme Court had given certain orders, but there were some delays. "Tomorrow is the last date (for setting up of SIT), therefore the very first agenda in accordance with its policy commitment was to have this very high-profile SIT," he said. The SIT will also prepare a comprehensive action plan, including creation of an institutional structure that could enable the country to fight the battle against unaccounted money. It should report on the status of its work to the court from time to time, the statement added.

GOWDA NON COMMITTAL ON PASSENGER FARE HIKE

A call on any passenger fare hike in trains

will be taken after discussions in the Cabinet and also with Prime

Minister Narendra Modi, Railway Minister Sadanand Gowda said today. "I

will have a discussion with my Cabinet colleagues. I will also have

discussions with railway officials. Finally I will have discussion with

honourable Prime Minister and then only whatever decision," he said

after assuming charge at Rail Bhawan here when asked whether Railways

will go for a hike in passenger fares and freight rates as proposed by

the previous government. "Unless I see the pros and cons of these

things, I cannot say right now. Certainly, I need two weeks time to take

stock of the situation," Gowda further said. Reeling under financial

crunch, Railways had proposed 14.2 per cent hike in passenger fares and

6.5 per cent increase in freight rate on May 16. The hike was to be

effected from May 20. However, Railways put the hike order notification

on hold and issued another saying let the next government take a

decision on it. "I will also discuss with railway officials about the

problems we are facing... what are pending projects. All these things

have to discussed and then only I will decide," Gowda said. About

taking up new projects, he said, "I have to do a detailed study. I need

to discuss it in details. I will also discuss with the prime minister

because he has some noble ideas on rail sector. He has already expressed

his views on it during the election campaign." Gowda said he will draw

a road map for Railways after 10 days after detailed discussion with

everybody concerned.

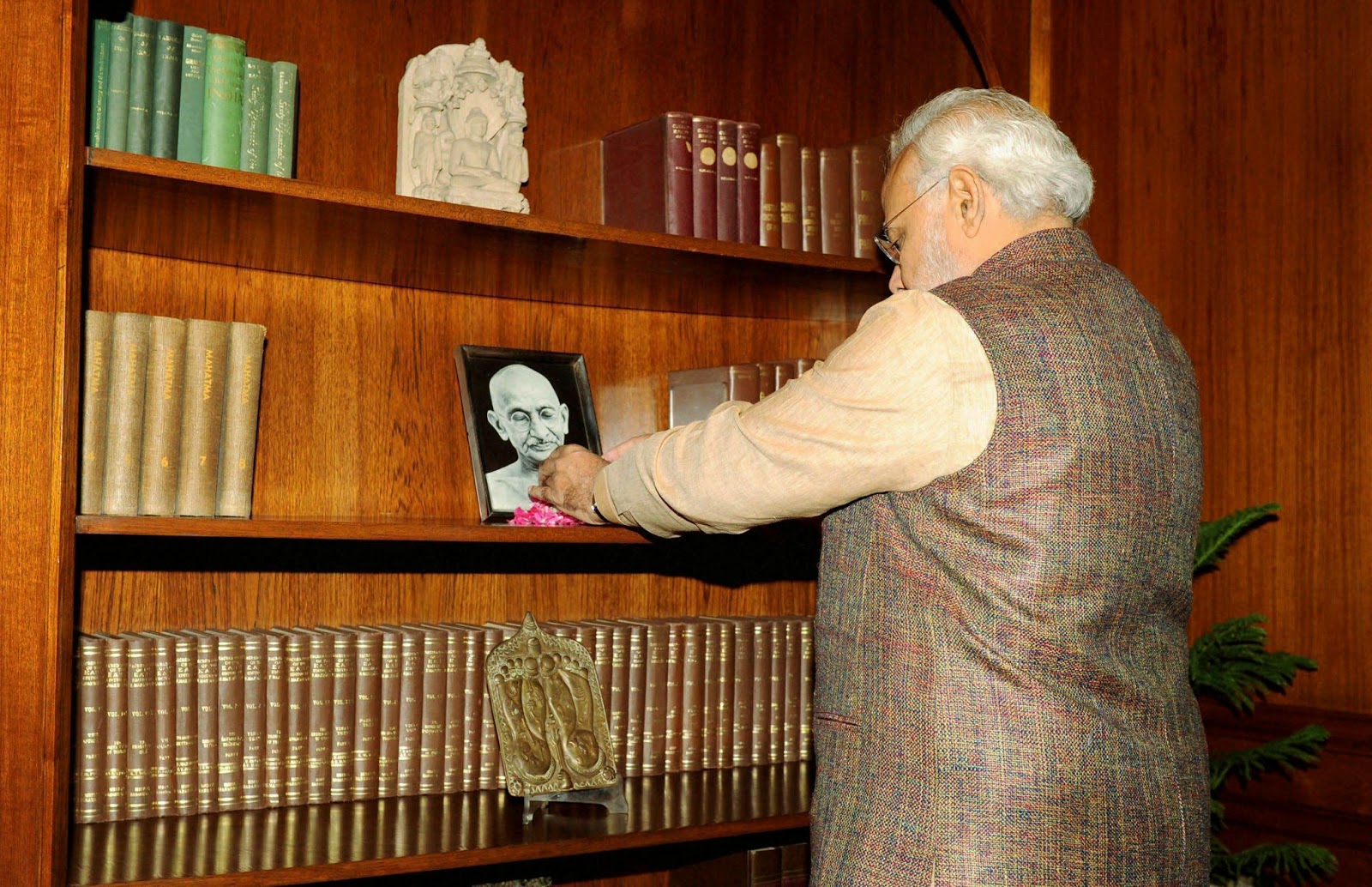

PMO's TWITTER REVAMPED

The Prime Minister's Office under

Narendra Modi today took control of Twitter handle @PMOIndia that was

relinquished by the previous dispensation under Manmohan Singh last week

and had led to a controversy with BJP terming it "disgraceful and

illegal". The first tweet from the PMO was about the Prime Minister

Modi offering tributes to Mahatma Gandhi with the photograph showing him

paying homage to the Father of the Nation. The next tweet invited its

1.27 million followers to the revamped official webside of the PMO. The

twitter handle @PMOIndiaArchive, which was created by the previous PMO

and to which all previous PMO tweets were shifted, could not be traced

today. "Sorry, that page does not exist!," was the message shown by

Twiiter when the handle was searched. However, a tweet from @PMOIndia

said all tweets posted by the Singh's office have been archived at the

PMO website. "All Tweets from this account up till 26th May 2014 have

been archived and can be seen here," it said, giving the link. BJP and

Congress had sparred after the then Communication Adviser to Singh,

Pankaj Pachauri, informed people through a series of tweets last week

about the decision to free handle @PMOIndia and move to a new handle.

After much furore, a PMO statement had clarified the original handle,

which was briefly captured by a squatter, had been secured by Twitter

and will be handed over to the new dispensation. The Modi government

has apparently also managed to get all the followers who were following

the handle earlier but were moved to the new handle.

MODI's CRACK TEAM ON ACTION

|

| MODI FIRST CABINET MEET |

Prime Minister Narendra Modi's crack team of economic ministers led by Arun Jaitley in finance today began the Herculean task of arresting price rise, reviving investor confidence and boosting growth. Jaitley, who has also been given the Ministry of Corporate Affairs, pledged to contain the price rise, restore the confidence of investors in the economy and promote growth while keeping the fiscal deficit under check. New Telecom and Law Minister Ravi Shankar Prasad made the right noises on retrospective tax, which has been severely criticised by industry and foreign investors, and promised a stable fiscal regime to lure overseas investments. Former BJP president and party heavyweight Nitin Gadkari, who turned 57 today, will take charge of the Road Transport and Highways and the Shipping ministries on Wednesday. Three others -- Minister for Micro, Small and Medium Enterprises Kalraj Mishra, Fertiliser Minister Ananth Kumar and Heavy Industries and Public Enterprises Minister Anant Geete -- also did not take charge today. Ramvilas Paswan, who assumed charge of the Ministry of Consumer Affairs, Food & Public Distribution, said his priority would be to streamline the working of FCI and making the public distribution system more effective. Apart from Jaitley, Prasad and Paswan, some ministers holding economic portfolios are first-timers with no background of handling high-profile assignments. After taking charge, Commerce and Industry Minister Nirmala Sitharaman reaffirmed the BJP's stand of not allowing foreign direct investment in multi-brand retail, but said her government will take steps to boost exports and create jobs. Chartered accountant Piyush Goyal, now in charge of the warring coal and power ministries, vowed to end electricity shortages as he looked to develop synergies between fuel supply and power projects. He also holds the renewable energy portfolio. Oil Minister Dharmendra Pradhan hinted at keeping the common man's interest in mind while deciding on issues such as natural gas price hike and fuel price de-regulation.

After Jaitley took charge,

Reserve Bank of India Governor Raghuram Rajan called on him and they discussed

inflation and other macro economic issues. During his media interaction,

Jaitley said the country's economy was passing through difficult times.

"The challenges are very obvious. We have to restore the pace of growth,

contain inflation, and obviously concentrate on fiscal consolidation

itself," he said. Telecom Minister Prasad said improving service quality,

restoring the confidence of investors and creating a broadband network would be

his priorities. New Textiles Minister Santosh Kumar Gangwar took charge and

pledged to work towards promoting Brand India abroad and boosting the country's

textile exports. Talking to reporters, Consumer Affairs, Food & Public

Distribution Minister Paswan said the procurement system will be strengthened

to ensure that its benefits reach the farmers. Minimum support price and

monitoring of prices of essential commodities are the other important issues.

After taking charge, Minister for Food Processing Industries Harsimrat Kaur

Badal said her mission would be to find new and innovative ways to reduce post-harvest

losses. Minister of State (Independent Charge) for Planning and Statistics and

Programme Implementation Inderjit Singh Rao also took charge today.

MODI TAKES CHARGE

|

| Narendra Modi paying tribute to Mahatma Gandhi after taking charge of the office at PMO |

Soon after he was sworn-in as Prime Minister, Modi sought support, blessings and active participation of the people to take India's development journey to newer heights. "Together we will script a glorious future for India," he said in his first message on the relaunched PMO website. "Let us together dream of a strong, developed and inclusive India that actively engages with the global community to strengthen the cause of world peace and development," he added.

FOCUS ON SOCIAL MEDIA

Asking people's support to script a glorious future for India, Prime Minister Narendra Modi tonight said he would be using social media to communicate with people across the world as he believed in a platform where views are shared. "I am a firm believer in the power of technology and social media to communicate with people across the world. I hope this platform creates opportunities to listen, learn and share one's views," he said in his letter to fellow Indians and citizens of the world. The letter posted on the official website of the Prime Minister said, "Through this website you (people) will also get all the latest information about my speeches, schedules, foreign visits and lot more. "I will also keep informing you about innovative initiatives undertaken by the government of India." He said the May 16 verdict delivered a mandate for development, good governance and stability. "As we devote ourselves to take India's development journey to newer heights, we seek your support, blessings and active participation. "Together we will script a glorious future for India. Let us together dream of a strong, developed and inclusive India that actively engages with the global community to strengthen the cause of world peace and development."HIGHEST EVER WOMEN STUDENTS IN ISB

The Class of 2015 of the Post Graduate

Programme in Management (PGP) at the Indian School of Business (ISB) has

the largest number of women students among premier business schools in

the country.

The Class of 2015 of the PGP course at ISB has 231 women students, constituting 30 per cent of the total class size, the highest number ever since the school's inception thirteen years ago, ISB said in a statement.

The number of women students at the school has been rising steadily and has increased by almost by 120 per cent in the last seven years, it added. "This is a heartening development and is a result of the various initiatives that we have undertaken to encourage women professionals to take up management as a career, in association with the corporate world over the last few years," ISB Deputy Dean Savita Mahajan said. "We hope this increased participation of women will go a long way in meeting the need for gender diversity across sectors, Mahajan added.

ISB's class of 2015 has a total 763 students (Hyderabad- 553 and Mohali-210). In terms of gender ratio, 30 per cent were female and 70 per cent were male. The average age of the students is 27 years and have a five years work experience, the statement added.

The Class of 2015 of the PGP course at ISB has 231 women students, constituting 30 per cent of the total class size, the highest number ever since the school's inception thirteen years ago, ISB said in a statement.

The number of women students at the school has been rising steadily and has increased by almost by 120 per cent in the last seven years, it added. "This is a heartening development and is a result of the various initiatives that we have undertaken to encourage women professionals to take up management as a career, in association with the corporate world over the last few years," ISB Deputy Dean Savita Mahajan said. "We hope this increased participation of women will go a long way in meeting the need for gender diversity across sectors, Mahajan added.

ISB's class of 2015 has a total 763 students (Hyderabad- 553 and Mohali-210). In terms of gender ratio, 30 per cent were female and 70 per cent were male. The average age of the students is 27 years and have a five years work experience, the statement added.

PREPAID ELECTRICITY METERS MAY REDUCE CONSUMPTION

Installing prepaid electricity meters in

India will have a similar "transformative" effect that was seen in the

telecom sector with prepaid services, as people would be able to manage

their consumption better, a Sri Lankan think tank LIRNEasia today said.

Discussing findings of survey on access to electricity covering India,

Sri Lanka and Bangladesh, LIRNEasia, an ICT policy and regulation think

tank, said that urban, low income micro-entrepreneurs (MEs) (0-9

employees) face issues in getting new connections and later on with the

quality of service. "In India, six per cent of MEs who said they did

not have a separate electricity connection for their business because

they did not have the right documents. As a result, they obtained

electricity from shared connections or illegal temporary connections,

often at a high cost," LIRNEasia co-founding Chair Helani Galpaya told

reporters here.

She added that this issue can be addressed using prepaid meters and easing the procurement process.

"Since the cost of electricity is paid in advance, the service provider does not run the risk of financial liability and costs involved in issuing bills through meter reader is also avoided. Consumer can top up the meter through a reload system," LIRNEasia co-founding Chair Rohan Samarajiva said.

The model has seen success in the telecom industry and has a potential to transform the electricity distribution system too, he added. The body is meeting state-level energy regulators from Bihar, Gujarat and Maharashtra to discuss the findings of the survey, which covered 1,279 people in India (Delhi and Patna).

Samarajiva also highlighted that use of mobile phones in communicating with customers about planned power cuts and complaint receipts can also play an important role in improving quality of service.

"Among the three nations, India had the highest number of people saying they received no communication in advance about power outages. Also 64 per cent of Indian MEs said they refrained from complaining as they felt there was no use. There are problems that can be addressed using SMS and make discoms more accountable to the public," he said.

She added that this issue can be addressed using prepaid meters and easing the procurement process.

"Since the cost of electricity is paid in advance, the service provider does not run the risk of financial liability and costs involved in issuing bills through meter reader is also avoided. Consumer can top up the meter through a reload system," LIRNEasia co-founding Chair Rohan Samarajiva said.

The model has seen success in the telecom industry and has a potential to transform the electricity distribution system too, he added. The body is meeting state-level energy regulators from Bihar, Gujarat and Maharashtra to discuss the findings of the survey, which covered 1,279 people in India (Delhi and Patna).

Samarajiva also highlighted that use of mobile phones in communicating with customers about planned power cuts and complaint receipts can also play an important role in improving quality of service.

"Among the three nations, India had the highest number of people saying they received no communication in advance about power outages. Also 64 per cent of Indian MEs said they refrained from complaining as they felt there was no use. There are problems that can be addressed using SMS and make discoms more accountable to the public," he said.

NIFTY OUTLOOK FOR 28th & REVIEW

FORENOON BETTER...PROFIT BOOKING TOWARDS CLOSE...

Nifty continues correction for the Second day in a row but closed above 7300 mark. Stop loss for Nifty may be maintained at 7265 (on close basis). Scrip specific movement can be expected in view of the last Two days of Derivative settlement. While Global cues, Quarterly results and Funds flow are expected to broadly guide the market movement, based on the present market position , market can be expected to be generally better in the forenoon and might encounter selling pressure in the closing session.

Nifty

Review for Tuesday :: Narrow Movements… General Bearish Bias… !!!

Market traded with negative bias through out the day and

closed with a loss of more than 0.60%. 30 of Nifty stocks ended in the red and

broader market too was weak with Advance Decline ratio at about 1:1.7. IT,

Media, Metal, Pharma indices gained while PSU Bank, Energy, Realty, Auto and

Infra indices closed weak for the day. Infy, HDFC Bank, L&T contributed about

15 20 points to Nifty’s gain while HDFC,

Reliance, SBI dragged down by more

than 20 points.

Jindal Steel, Tech Mahindra, Tata Steel, Infy, Lupin remained gainers among Nifty stocks while GAIL, BHEL, PNB,

Bank of Baroda, IDFC remained major losers.

Bharat Forge Jindal Steel, Just Dial, Havells, Aurobindo remained major gainers

among F&O stocks while GAIL, Unitech, IFCI, PFC, BHEL declined among F&O stocks.

PROFIT BOOKING RATTLES MARKET

he benchmark Sensex today retreated from a record and fell for the first time in four days weighed down by selling in power and oil shares as Prime Minister Narendra Modi allotted portfolios to his council of ministers. Mixed global cues with downward bias amid offloading of positions by foreign funds in view of monthly equity derivatives expiry also impacted the market, a broker said. The BSE 30-share barometer resumed slightly better, but fell back immediately and remained in negative for rest of the day to end at 24,549.51, a fall of 167.37 points or 0.68 per cent. In previous three days, it had gained 418.86 points, or 1.72 per cent, to end at record closing high of 24,716.88. "Possibly, profit booking coupled with disappointment over the appointment of key ministries could have led to market decline. All indices were in red except IT, Metals and Healthcare," said Sanjeev Zarbade, Vice President- Private Client Group Research, Kotak Securities. The broad-based NSE 50-issue CNX Nifty also dropped 41.05 points, or 0.56 per cent, to end at 7,318.00. A narrowing current account deficit at 1.7 per cent of GDP in FY'14 from 4.7 per cent in FY'13 was apparently ignored by market participants, said equity dealers. Selling activity was seen picking up in mid and small-cap stocks largely in line with overall trends, they added. Renewed capital outflows too affected the market sentiment. Foreign institutional investors (FIIs) sold shares worth a net Rs 84.13 crore yesterday as per provisional data from the stock exchanges. Gail India was the top loser from the Sensex pack with a fall of 7.56 per cent even as net profit rose year-on-year. Besides Gail India, HDFC, RIL, SBI, ONGC, M&M, Tata Motors, TCS and BHEL also suffered losses while Infosys, L&T, HDFC Bank, Tata Steel and Hindalco attracted buying. "With the derivatives expiry on Thursday markets are likely to be volatile. Even for initiating fresh shorts traders should wait for some pullback or consolidation to take place at higher levels," said Jayant Manglik, President-retail distribution, Religare Securities.MODI SWUNG INTO ACTION

BIG RESTRUCTURING OF MINISTRIES

In a restructuring of his Cabinet, Prime Minister Narendra Modi today combined 17 related ministries into seven different groups, including some infrastructure departments, in an apparent bid to ensure synergy and better results. First the Ministry of Overseas Indian Affairs, created in UPA-II, has been brought together with External Affairs Ministry under Sushma Swaraj while Corporate Affairs has been brought back to Finance under Arun Jaitley. In infrastructure sector, the Prime Minister has combined Road Transport and Highways and Shipping in the ministry to be headed by Nitin Gadkari, who had made a name for himself by adopting an innovative approach in expanding road transport network and bridges in Maharashtra when he was a minister there in BJP-Shiv Sena Government. Another important infrastructure combination is bringing together Power, Coal and New and Renewable Energy under the independent charge of Minister of State Piyush Goyal. These used to be separate ministries with Cabinet ministers incharge in the UPA governments.Related ministries of Urban Development, Housing and Poverty Alleviation have been placed under the charge of M Venkaiah Naidu, while Rural Development, Panchayat Raj and Drinking Water and Sanitation have been grouped together under the charge of Gopinath Munde. In another minor combination of ministries, Goa's Shripad Naik has been charge of Culture and Tourism as Minister of State with independent charge. However, this is not the first time that ministries have been brought together for the purpose of efficiency and homogeneity. Late Prime Minister Rajiv Gandhi brought together infrastructure department of Railways, Shipping and Civil Aviation under one combined ministry of Transport headed by the late Bansi Lal. He had three Ministers of States to help him. Gandhi also clubbed education, culture and women and child development under the Ministry of Human Resources Development under late P V Narasimha Rao. The HRD ministry was created for the first time then. Former Prime Minister Atal Bihari Vajpayee during his tenure had brought Information Technology and Communication under one umbrella while his successor Manmohan Singh had brought together Surface Transport and Shipping.

MUMBAI FAVOURITE PLACE FOR UAE NRI's

Mumbai has emerged as the top Indian city

for property investments by NRIs in the UAE with Bangalore being the

second most popular, according to a survey. Mumbai retained the top

spot with 31.86 per cent NRIs preferring to make property investments in

the city, a recent survey on Indian properties by Sumansa Exhibitions,

the organisers of the Indian Property Show in Dubai, said. Bangalore

came in second with 24.35 per cent preferring to invest in residential

property in the coming months, the survey said. Chennai and Pune

jointly hold the third place with almost equal percentage of people

preferring these cities. Delhi has the fourth position followed by

Cochin, Navi Mumbai, Gurgaon and Hyderabad. "Bangalore's property

market bucked the trend in other metros with many new launches, good

demand and resilient prices. Sector experts predict that residential

property in the city will remain a good bet for 2014, too," said Sunil

Jaiswal, CEO Sumansa Exhibitions. "Bangalore is the third-largest real

estate investment hub for High Net worth Individuals (HNIs) and tops the

list in terms of investments from Non Resident Indians (NRIs) looking

at settling down in India in the future", said Jaiswal. "With a high

net-worth individuals population of about 10,000 the third highest in

the country after Delhi and Mumbai Bangalore's super-luxury segment is

also worth watching," he said. The property exhibition organised by the

group will be held from June 12 to 14. According to the survey, 31 per

cent NRIs looking for properties in the price range of 76 lakhs and

above, 52.57 per cent look for mid segment range of 26-75 lakhs and

demand for high end segment, 1 crore plus, is at 16 per cent.

Residential apartments are all time favourite with 77.17 per cent

interested in buying one, compared with villas or commercial property.

The highest number of buyers is in the age group of 36-50 years at 67

per cent, the survey said adding that 72 per cent buyers aim for

immediate purchase within next 6 months. More than 14,700 NRIs from

across UAE participated in the survey.

NEXT 30 DAYS BEST FOR REALTY INVESTMENT

Nearly 60 per cent of

Indians think that next one month would be a good time to buy real estate with

improvement in consumer sentiments following formation of a stable government,

according to a survey by global research firm Ipsos.

"Almost six in ten (57 per cent) Indians think the next 30 days will be a good time to buy real estate, such as a house, vacation property or investment property," Ipsos said in a statement.

Founded in France in 1975, Ipsos is an independent market research company controlled and managed by research professionals.

"With the formation of a new stable government at the Centre, the consumer sentiment which was low in the last 2 years has improved significantly. The stock market has already reacted in a positive manner reflecting this change, the real estate prices are expected to go northwards by the end of the year," said Bhasker Canagaradjou, Associate Director, Ipsos Business Consulting. The realtors reeling under large scale of debt are offering discounts to reduce their inventory levels taking advantage of the new found optimism in the market. The residential real estate market may see an uptick in the demand and increase in the number of transactions in the near future, he added. Majority (65 per cent) of people in Russia think next 30 days would be a good time to buy property followed by India (57 per cent), Indonesia (55 per cent), Ireland (51 per cent), Great Britain (47 per cent), Mexico (44 per cent), Australia (42 per cent), Hungary (42 per cent). "Those rounding out the middle of the pack are from the United States (41 per cent), Germany (40 per cent), Canada (39 per cent), Italy (38 per cent), Argentina (37 per cent), South Africa (37 per cent), Sweden (37 per cent), Poland (35 per cent) and Spain (34 per cent). The survey was conducted in 26 countries with a total sample of 20,144 adults age 18-64 in the US and Canada, and age 16-64 in all other countries.

"Almost six in ten (57 per cent) Indians think the next 30 days will be a good time to buy real estate, such as a house, vacation property or investment property," Ipsos said in a statement.

Founded in France in 1975, Ipsos is an independent market research company controlled and managed by research professionals.

"With the formation of a new stable government at the Centre, the consumer sentiment which was low in the last 2 years has improved significantly. The stock market has already reacted in a positive manner reflecting this change, the real estate prices are expected to go northwards by the end of the year," said Bhasker Canagaradjou, Associate Director, Ipsos Business Consulting. The realtors reeling under large scale of debt are offering discounts to reduce their inventory levels taking advantage of the new found optimism in the market. The residential real estate market may see an uptick in the demand and increase in the number of transactions in the near future, he added. Majority (65 per cent) of people in Russia think next 30 days would be a good time to buy property followed by India (57 per cent), Indonesia (55 per cent), Ireland (51 per cent), Great Britain (47 per cent), Mexico (44 per cent), Australia (42 per cent), Hungary (42 per cent). "Those rounding out the middle of the pack are from the United States (41 per cent), Germany (40 per cent), Canada (39 per cent), Italy (38 per cent), Argentina (37 per cent), South Africa (37 per cent), Sweden (37 per cent), Poland (35 per cent) and Spain (34 per cent). The survey was conducted in 26 countries with a total sample of 20,144 adults age 18-64 in the US and Canada, and age 16-64 in all other countries.

NET CAPITAL INFLOWS RISE SHARPLY

The net capital inflows to

India are likely to increase sharply in FY'15, buoyed by the historic

victory of the BJP-led NDA headed by Prime Minister Narendra Modi, says a

Nomura report. According to the global financial services firm, this

historic victory has enthused investor confidence that the government

will pursue reforms and policies that will put India back on high growth

trajectory over the medium term. "We expect a USD 25 billion balance

of payments surplus in FY'15," Nomura said in a research note.

According to the report, the import bill is likely to rise slightly on

gradual relaxation in gold import restrictions and the non-gold import

bill may also rise slightly as growth picks up in the latter half of

FY'15. The rise in import bill will be offset by strong exports on the

back of higher global demand, it said. "Overall, we expect the current

account deficit (CAD) to remain within sustainable levels, under 2 per

cent of GDP in FY'15," the report said. According to RBI data released

yesterday, in FY'14, CAD narrowed to 1.7 per cent of GDP, or USD 32.4

billion, from 4.7 per cent, or USD 87.8 billion, in the previous fiscal.

The decline in the deficit continues to be driven by lower gold

imports and softer non-oil, non-gold demand, which helped contain the

merchandise trade deficit, experts said. British brokerage firm

Barclays also believes that given the government's measures to restrict

gold imports largely remain in place, we do not think the current

account deficit will widen significantly in the first half of FY'15.

CAD is expected to be lower than the earlier forecast of USD 50 billion

(2.4 per cent of GDP) in FY'15. India's current account deficit

narrowed sharply to USD 1.2 billion, or 0.2 per cent of GDP, in Q4 of

FY'14 from USD 18.1 billion, or 3.6 per cent of GDP, a year ago. In the

December quarter, it stood at USD 4.2 billion or 0.9 per cent of GDP.

The lower CAD was primarily on account of a decline in trade deficit as

imports fell sharper than exports.

Monday, May 26, 2014

CARNIVAL ATMOSPHERE

he occasion was ceremonial but it was a

carnival atmosphere as Narendra Modi was sworn in as Prime Minister

before the largest-ever gathering at Rashtrapati Bhawan, which became a

confluence of people as varied as Presidents, Prime Ministers, film

stars, corporate and religious leaders.

Never before have well over 4000 people gathered in the forecourt of the majestic Presidential house as they did today to watch the change of guard from Manmohan Singh to the man from Gujarat for whom the oath-taking ceremony was the culmination of a breathtaking political journey.

The heat did not deter the Modi admirers who had come hours ahead. There were a few fans to cool them but they mostly depended on their invitation cards to generate some breeze till the sun set and made it bearable.

'Modi, Modi' up went the chants when the PM-designate arrived shortly before 6 PM as if this was yet another of his election gatherings that the nation had witnessed over the past many months.

Before Modi arrived, his special guests from abroad--Prime Minister Nawaz Sharif of Pakistan, Nepal PM Sushil Koirala, Sri Lankan President Mahinda Rajapakse and other SAARC leaders--had taken their front-row seats. As each name was announced there were cheers, the loudest being reserved for the Pakistani leader.

Wearing a pastel-coloured Nehru jacket over a full-sleeved off-white Kurta and sporting a tri-coloured badge, Modi took oath in Hindi in the name of God. He was lustily cheered. The next to take oath was Rajnath Singh, the leader seen most with the new Prime Minister during the election campaign. He was followed by another party veteran Sushma Swaraj and then Arun Jaitley.

Modi became the third Prime Minister since Atal Bihari Vajpayee and Chandra Shekhar to assume the top office in the sprawling red-sand forecourt. The glamour quotient in the ceremony came from cinestars Salman Khan and Vivek Oberoi, actor-turned-politicians Hema Malini and Shatrughan Sinha, who have been elected in the recent elections, and her husband Dharmendra, who were all seen enjoying the moment. The presence of large number religious gurus, many of whom added saffron tint to the ceremony, including Sri Sri Ravi Shankar, Morari Bapu, Jagadguru Rambhadracharya, Sadhvi Rithambara was prominent in the front row of guests. While Mukesh Ambani was accompanied by his wife Nita and two sons, his brother Anil brought his mother Kokilaben. Gautam Adani also came with his family.

SP President Mulayam Singh Yadav, Uttar Pradesh Chief Minister Akhilesh Yadav, Jammu and Kashmir Chief Minister Omar Abdullah were also present in the ceremony but Tamil Nadu Chief Minister J Jayalalitha, West Bengal Chief Minister Mamata Banerjee and Odisha Chief Minister Navin Patnaik gave it a miss.

Never before have well over 4000 people gathered in the forecourt of the majestic Presidential house as they did today to watch the change of guard from Manmohan Singh to the man from Gujarat for whom the oath-taking ceremony was the culmination of a breathtaking political journey.

The heat did not deter the Modi admirers who had come hours ahead. There were a few fans to cool them but they mostly depended on their invitation cards to generate some breeze till the sun set and made it bearable.

'Modi, Modi' up went the chants when the PM-designate arrived shortly before 6 PM as if this was yet another of his election gatherings that the nation had witnessed over the past many months.

Before Modi arrived, his special guests from abroad--Prime Minister Nawaz Sharif of Pakistan, Nepal PM Sushil Koirala, Sri Lankan President Mahinda Rajapakse and other SAARC leaders--had taken their front-row seats. As each name was announced there were cheers, the loudest being reserved for the Pakistani leader.

Wearing a pastel-coloured Nehru jacket over a full-sleeved off-white Kurta and sporting a tri-coloured badge, Modi took oath in Hindi in the name of God. He was lustily cheered. The next to take oath was Rajnath Singh, the leader seen most with the new Prime Minister during the election campaign. He was followed by another party veteran Sushma Swaraj and then Arun Jaitley.

Modi became the third Prime Minister since Atal Bihari Vajpayee and Chandra Shekhar to assume the top office in the sprawling red-sand forecourt. The glamour quotient in the ceremony came from cinestars Salman Khan and Vivek Oberoi, actor-turned-politicians Hema Malini and Shatrughan Sinha, who have been elected in the recent elections, and her husband Dharmendra, who were all seen enjoying the moment. The presence of large number religious gurus, many of whom added saffron tint to the ceremony, including Sri Sri Ravi Shankar, Morari Bapu, Jagadguru Rambhadracharya, Sadhvi Rithambara was prominent in the front row of guests. While Mukesh Ambani was accompanied by his wife Nita and two sons, his brother Anil brought his mother Kokilaben. Gautam Adani also came with his family.

SP President Mulayam Singh Yadav, Uttar Pradesh Chief Minister Akhilesh Yadav, Jammu and Kashmir Chief Minister Omar Abdullah were also present in the ceremony but Tamil Nadu Chief Minister J Jayalalitha, West Bengal Chief Minister Mamata Banerjee and Odisha Chief Minister Navin Patnaik gave it a miss.

|

| RELEASING BALLONS |

|

| LIGHTING CRACKERS |

|

| DHIONI @ CEREMONY |

|

| FORECOURT |

|

| DHARMENDRA, JOSHI, HEMAMALINI, KOILA BEN |

|

| GAVASKAR, SALMAN |

|

| SATRUGHAN SINHA, ANUPAM KHER, HEMAMALINI |

|

| SONIA RAHUL |

|

| ANIL, POONAM THILLON |

MORGAN STANLEY PREDICT RETURN OF RETAIL INVESTORS

Domestic markets may see the return of retail investors finally as earnings from equities have turned positive in recent months, brokerage firm Morgan Stanley said in a report today. Retail investors could become net buyers soon from being net sellers for long, it said, adding that financial savings should see a boost in the coming 24 months if the government commits itself to bringing down inflation leading to a marginal rise in real rates, which in turn will help the retail segment to remain invested. The share of equities within that could also rise given the improving real return on equities and the starting point of equity ownership relative to fixed income, it added. The anchoring to physical assets, especially gold, is likely to be shaken in the coming months, the report said. Morgan Stanley said the low and negative real rates of the past four years have fuelled demand for gold and property. Gold demand has historically not been as high as it has been in the past five years. "Now, we think real rates may continue to rise largely due to tempering of inflation - this means property and gold will give up share in total savings," it said. The mix of equities in financial savings is driven by trailing real equity returns. Trailing returns are rising and this is good for equity flows. In addition, the other factor is the ratio of equities to fixed income, this ratio shows very high under-allocation to equities. Already, India has underlying structural factors to drive equity savings. Choice between equities and gold is driven also by the relative returns of the two asset classes. The equities are gaining at the expense of gold and, therefore, the relative equity flows to gold could also reverse in the coming months. While property has strong underling demand driven by nuclearisation of families, need for better housing and good affordability (house prices relative to incomes), the investment demand for homes could also come under relative pressure as households make a shift in favour of financial assets, it said.

MODI SWORN IN AS 15th PRIME MINISTER OF INDIA

Marking the beginning of a new era in Indian politics, Narendra

Modi was today sworn in Prime Minister at the head of a 45-member

coalition government after the elections threw the first government with

absolute majority in 30 years.

63-year-old Modi, the first

leader to get a landslide majority for BJP on its own, became the 15th

prime minister in a virtual 'coronation' ceremony in the forecourt of

the Rashtrapati Bhawan before a 3000-strong gathering, the largest

audience at the swearing in a of new government.

Rajnath Singh, Sushma Swaraj, Arun Jaitley, M Venkaiah Naidu, Nitin Gadkari, Uma Bharti, Maneka Gandhi, Ananth Kumar, Ravi Shankar Prasad, Smriti Irani and Harsh Vardhan were among those who were sworn in as Cabinet ministers.

Ram Vilas Paswan (LJP), Harsimrat Kaur Badal (Akali Dal), Anant Geete (Shiv Sena) and Ashok Gajapathi Raju (TDP) were those from allied parties who took the oath today.

Dignitaries from politics, industry, cinema and religion, capped by leaders of SAARC nations including Pakistan Prime Minister Nawaz Sharif, watched Modi take the oath of office and secrecy in Hindi.

"Together we will script a glorious future for India... As we devote ourselves to take India's development journey to newer heights, we seek your support, blessings and active participation," Modi said in his first message on the official website. He also said " Let us together dream of a strong, developed and inclusive India that actively engages with the global community to strengthen the cause of world peace and development." Various new sections have been introduced on the entirely revamped official website of the Prime Minister's Office and include a category on Modi's personal life. A short profile was also uploaded on www.pmindia.nic.in which described him as "dynamic, dedicated and determined" leader who "arrives as a ray of hope in the lives of a billion Indians". It said his "laser focus on development and his proven ability" to deliver results have made him one of India's most popular leaders. Without naming RSS, it said that from a very young age, Modi immersed himself in service to the nation, working with "patriotic organisations". An option called "Wish the Prime Minister" takes a user to Modi's personal website. Underlining that the website was a very important medium of direct communication between him and people, he said "I am a firm believer in the power of technology and social media to communicate with people across the world". Modi hoped the platform creates opportunities to listen, learn and share one’s views. "Through this website, you will also get all the latest information about my speeches, schedules, foreign visits and lot more. I will also keep informing you about innovative initiatives undertaken by the Government of India," he said. The website also has a section on his personal life which includes various phases from being a young child to RSS volunteer to BJP leader.

Prime Minister Narendra Modi's mother

Hiraben, who could not attend her son's swearing-in ceremony at

Rashtrapati Bhavan today, ensured she keeps pace with the developments

on television. Sitting in a small room with her family members,

92-year-old Hiraben watched live coverage of the gala event. She seemed

unperturbed by scores of cameramen and reporters who had crowded the

room to seek her reaction. Modi was blessed by his mother at her home

in Gandhinagar after BJP won the electoral mandate to form the next

government at the Centre. "He has my blessings and he will lead the

country towards development," she had said after blessing her son. She

stays with her other son Pankaj Modi in Gandhinagar.

Both the youngest and the oldest members of

the Narendra Modi Cabinet happens to be women - Smriti Irani and Najma

Heptullah. While Irani is 38 years old, Heptullah is 74. Incidentally,

both of them are from the Rajya Sabha representing Gujarat and Madhya

Pradesh respectively. Irani, who had unsuccessfully contested against

Congress Vice President Rahul Gandhi in Amethi, has been sworn-in as

Union Cabinet Minister as is Najma. A former National President of

BJP's women's wing, Irani now holds the position of Vice President in

the party. Irani was born in Delhi and had her education in the

national capital before she shifted to Mumbai and became a household

name because of her role in the TV serial "Saas Bhi Kabhi Bahu Thi" for

her portrayal of the character of Tulsi. Heptullah was Deputy

Chairperson of Rajya Sabha and had shifted to BJP from Congress. The

other women members of the Union Cabinet include Sushma Swaraj, Uma

Bharti, Maneka Gandhi and Harsimrat Kaur Badal.

|

| SIGNING IN THE BOOK |

Rajnath Singh, Sushma Swaraj, Arun Jaitley, M Venkaiah Naidu, Nitin Gadkari, Uma Bharti, Maneka Gandhi, Ananth Kumar, Ravi Shankar Prasad, Smriti Irani and Harsh Vardhan were among those who were sworn in as Cabinet ministers.

Ram Vilas Paswan (LJP), Harsimrat Kaur Badal (Akali Dal), Anant Geete (Shiv Sena) and Ashok Gajapathi Raju (TDP) were those from allied parties who took the oath today.

Dignitaries from politics, industry, cinema and religion, capped by leaders of SAARC nations including Pakistan Prime Minister Nawaz Sharif, watched Modi take the oath of office and secrecy in Hindi.

RELAUNCH OF OFFICIAL WEBSITE

Seconds after Narendra Modi was sworn-in as Prime Minister, the PMO website was relaunched carrying his message seeking support, blessings and active participation of the people who, he said, have delivered a mandate for development, good governance and stability."Together we will script a glorious future for India... As we devote ourselves to take India's development journey to newer heights, we seek your support, blessings and active participation," Modi said in his first message on the official website. He also said " Let us together dream of a strong, developed and inclusive India that actively engages with the global community to strengthen the cause of world peace and development." Various new sections have been introduced on the entirely revamped official website of the Prime Minister's Office and include a category on Modi's personal life. A short profile was also uploaded on www.pmindia.nic.in which described him as "dynamic, dedicated and determined" leader who "arrives as a ray of hope in the lives of a billion Indians". It said his "laser focus on development and his proven ability" to deliver results have made him one of India's most popular leaders. Without naming RSS, it said that from a very young age, Modi immersed himself in service to the nation, working with "patriotic organisations". An option called "Wish the Prime Minister" takes a user to Modi's personal website. Underlining that the website was a very important medium of direct communication between him and people, he said "I am a firm believer in the power of technology and social media to communicate with people across the world". Modi hoped the platform creates opportunities to listen, learn and share one’s views. "Through this website, you will also get all the latest information about my speeches, schedules, foreign visits and lot more. I will also keep informing you about innovative initiatives undertaken by the Government of India," he said. The website also has a section on his personal life which includes various phases from being a young child to RSS volunteer to BJP leader.

MODI MOTHER WATCH LIVE IN TV

|

| MODI MOTHER LIVE WACHING |

|

| FORE COURT OF PRESIDENT PALACE |

|

| NEW MINISTRY |

|

| TRIBUTE TO MAHATMA |

|

| PAYING TRIBUTE TO FATHER OF THE NATION |

|

| JUBILANT BOY |

|

| OFFERING ARTI |

|

| MODI FAMILY |

|

| OFFERING SWEETS |

|

| MODI PROFILE |

HEPTHULLA OLDEST & SMRITI IRANI OLDEST IN CABINET

|

| TEAM MODI |

DIVIDEND PAYMENTS THROUGH BORROWED MONEY

Aggressive

dividend payouts by top 500 companies has seen 419 of them together borrowing

around Rs 20,000 crore, while paying around Rs 1.2 trillion (Rs 1.2 lakh crore)

in FY'14, according to India Ratings. "Several BSE 500 corporates,

excluding banks and financial services companies, adopted an aggressive

dividend payment strategy in FY'14, despite a reduction in their net profit.

"We expect 419 of these corporates to have paid an aggregate dividend of

Rs 1-1.2 trillion in the fiscal and availed aggregate debt of Rs 18,000-20,000

crore for the same," as per the data collated by the rating agency. The

agency estimates 419 corporates availed Rs 19,180 crore of debt in FY'14 to

fund the aggregate dividend payment of Rs 1,04,900 crore. The trend of dividend

payment behaviour over FY'09-FY'13 suggests that in most instances cash flow

from operations was adequate and instances of debt requirement declined

steadily from FY'11-FY'13. "However, the total quantum of debt needed rose

sharply in FY'13 (after declining in FY'12) due to an increase in dividend

payments and a reduction in net profit. As many as 37 public sector units among

the 419 corporates paid aggregate dividend of Rs 45,060 crore in FY'13, and of

these, eight of them had to borrow Rs 12,890 crore to make the payments.

However, considering the sovereign linkage of these companies, their credit

profiles are unlikely to be impacted, it added. But more worrisome may be the

case of 12 private corporates with high leverage (above 5 times) which could

have borrowed an estimated Rs 2,770 crore to pay dividends. Lenders have to

watch out for corporates whose cash flow from operations (CFO) is negative or

have CFO below the amount of divided paid, while PAT may be positive. In some

of these cases, dividend payments could be financed by debt, even when

financial leverage is high. As such, some loan documents have covenants with

respect to dividend payments, but they usually require the borrower to inform

or seek approval from bankers before paying dividends. Decision triggers are

usually accounting profit, balance sheet net-worth or debt/equity ratio. Under

the new Companies Act, a corporate can pay dividend out of its current or past

accounting profit, in essence out of net income. However, it is possible that

while a corporate can generate positive net profit, its CFO may be negative due

to high working capital requirements to support revenue and EBITDA profits. In

such cases, a company paying dividend higher than its CFO is likely to tap its

cash reserves, investments and non-recurring income. If this is insufficient,

the company would effectively rely on debt to finance dividends. Reliance on

cash reserves or debt to partly or fully fund dividend payments has a negative

impact on net leverage (adjusted debt net of cash dividend/EBITDA) and the

overall credit profile, it added.

Subscribe to:

Posts (Atom)

ఈ వారంలో 25850 పైన బుల్లిష్

జూలై 7-11 తేదీల మధ్య వారానికి ఆస్ట్రో టెక్నికల్ గైడ్ నిఫ్టీ : 25461 (-177 ) గత వారంలో నిఫ్టీ 25639 - 24332 పాయింట్ల మధ్యన కదలాడి 17...

-

fo r April 25, 2019 Closing Subdued Tithi : Chaitra Krishna Saptemi Nakshatra : Poorvashadha Persons born in Mrigasira, ...

-

Stock Market created a Sunami on Monday as exit polls predicted NDA Government under Prime Minister Naredra Modi will get another term ...

-

fo r AUGUST 07 , 2019 Second Half Subdued Tithi : Sravana Sukla Saptami Nakshatra : Swathi Persons born in Krittika, Uttara,...