The

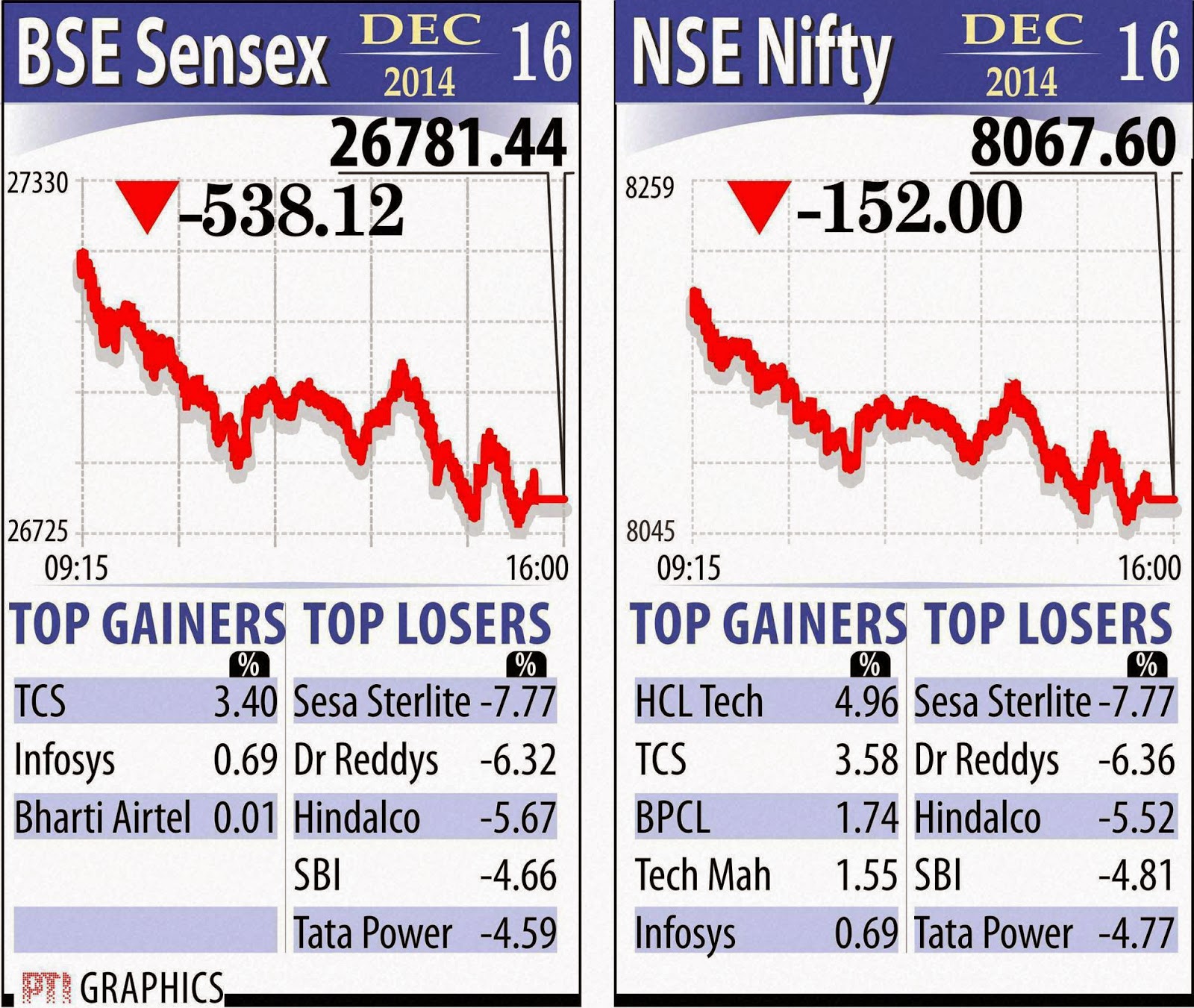

benchmark BSE Sensex tanked 538.12 points, its worst single-day drop

this year, to slip below 27,000-mark while the wider Nifty crashed

below 8,100 level due to capital outflows amid weak economic data and

sharp falls in global markets. A weakening rupee which slumped to a

13-month low and tumbling global markets on renewed concerns over

growth as crude oil prices crahsed to fresh multi-years low,

accelerated selling activity on the bourses, brokers said.

Meanwhile, the rupee tumbled by 64 paise, or 1 per cent, to hit a 13-month low of 63.58 against the dollar (intra-day).

Globally, Brent crude slumped to nearly USD 59 for the first time since 2009.

The 30-share Sensex closed at 26,781.44 points, down by 538.12 points, or 1.97 per cent. Today's drop is the biggest since September 3, 2013 when the BSE index tumbled by 651 points.

Meanwhile, the rupee tumbled by 64 paise, or 1 per cent, to hit a 13-month low of 63.58 against the dollar (intra-day).

Globally, Brent crude slumped to nearly USD 59 for the first time since 2009.

The 30-share Sensex closed at 26,781.44 points, down by 538.12 points, or 1.97 per cent. Today's drop is the biggest since September 3, 2013 when the BSE index tumbled by 651 points.

After cracking the

8,100-mark, the NSE Nifty touched the day's low of 8,052.60 before

settling down by 152 points, or 1.85 per cent, at 8,067.60.

India's trade deficit widened to one-and-a-half year high of USD 16.86 billion in November due to over six-fold jump in gold imports even as exports grew by 7.27 per cent. Among the Sensex constituents, 27 ended lower.

Sesa Sterlite was the biggest loser among 30 Sensex stocks. It slumped by 7.77 pc, followed by Dr Reddy (6.32 pc), Hindalco (5.67 pc) and SBI (4.66 pc).

The stocks of Tata Power (4.59 pc), ICICI Bank (4.30 pc) NTPC (3.20 pc), ITC Ltd (3.13 pc), Tata Steel (2.82 pc) and HDFC Ltd (3.11 pc) also dropped.

A weak Asian trend after data showed industrial acitivity is contracting in China and lower opening in Europe dampened the trading sentiments, brokers said.

Foreign Portfolio Investors sold shares worth a net Rs 455.72 crore yesterday as per provisional data. The BSE small-cap index lost 3.36 per cent and the mid-cap index fell 2.96 per cent.

India's trade deficit widened to one-and-a-half year high of USD 16.86 billion in November due to over six-fold jump in gold imports even as exports grew by 7.27 per cent. Among the Sensex constituents, 27 ended lower.

Sesa Sterlite was the biggest loser among 30 Sensex stocks. It slumped by 7.77 pc, followed by Dr Reddy (6.32 pc), Hindalco (5.67 pc) and SBI (4.66 pc).

The stocks of Tata Power (4.59 pc), ICICI Bank (4.30 pc) NTPC (3.20 pc), ITC Ltd (3.13 pc), Tata Steel (2.82 pc) and HDFC Ltd (3.11 pc) also dropped.

A weak Asian trend after data showed industrial acitivity is contracting in China and lower opening in Europe dampened the trading sentiments, brokers said.

Foreign Portfolio Investors sold shares worth a net Rs 455.72 crore yesterday as per provisional data. The BSE small-cap index lost 3.36 per cent and the mid-cap index fell 2.96 per cent.

No comments:

Post a Comment