SCRIP SPECIFIC MOVEMENT

Nifty closed flat and appears in a narrow range between

short term support and resistance. 6025 can be considered strong short term

support and 6175 can be considered resistance. Nifty spot is expected to encounter resistance

at 6100, 6135 and find support at 6020, 5985 for Thursday. While Global cues

and Funds flow are expected to broadly guide the market

movement, based on the present market position, market is expected to display volatile

movements with alternate bouts of bullishness and bearishness and scrip

specific movements are most likely in view of the last day of Derivative

expiry.

Nifty

Review for Wednesday,

27th November, 2013 :: Lackluster Movement

..!!

Market traded in a narrow range and closed flat for the day.

Market appears to be in a cautious mood ahead of F&O expiry and on the eve

of mini election battle. 29 of Nifty

stocks closed in the red and broader

market too was negative with Advance

Decline ratio placed at 1:1.4. Auto, FMCG, Metal indices gained while IT,

Infra, Realty, PSU Bank and Pharma indices slipped. Tata Motors, BPCL, Grasim,

Ultra Cement, Axis Bank remained gainers among Nifty stocks while JP

Assiociates, Power Grid, Bharti, DLF, NTPC remained major losers among Nifty stocks.

Among F&O stocks,

HDIL, Voltas, PTC, UPL, JSW Steel

remained gainers while Adani Ports, JP Associates, Orient

Bank, Glenmark, Siemens, LIC Housing

remained major losers.

Dr.Bhuvanagiri Amaranatha Sastry

Astro Technical Analyst

Saketha Consultants, Hyderabad

He can be reached @sastry.saaketa@gmail.com

09848014561

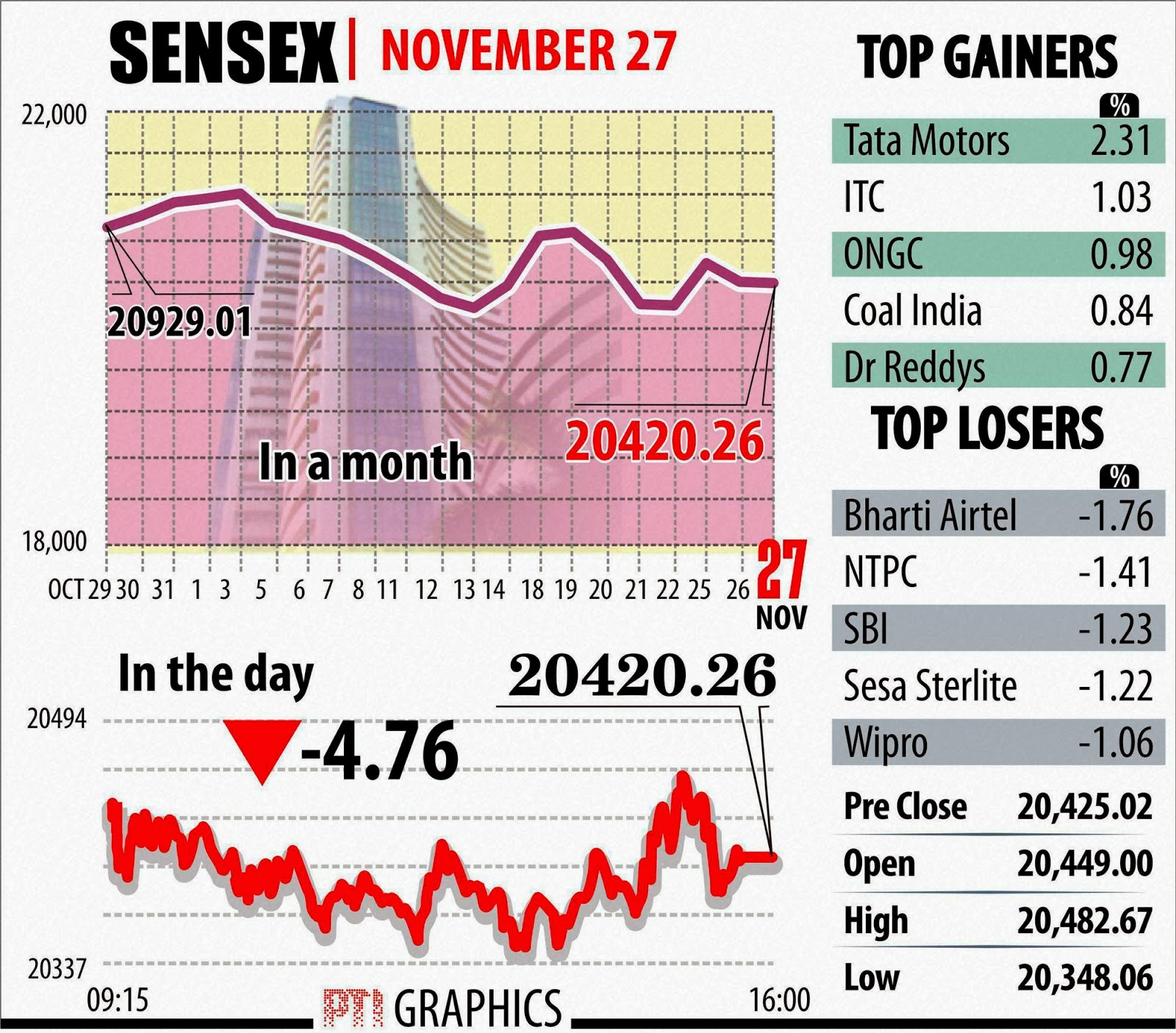

SENSEX ENDS IN RED AFTER

CHOPPY SESSION

The benchmark Sensex fell 5

points after a choppy session today on the eve of the expiry of November

derivative contracts and ahead of GDP and fiscal deficit data due on Friday.

Heavyweights Infosys and Reliance Industries dragged the index lower even as

ITC and Tata Motors provided some support. Bharti Airtel, NTPC and State Bank

of India were the biggest of the 16 losers on the Sensex.

The S&P BSE Sensex opened higher at 20,449. It traded within a band of 20,348.06 to 20,482.67 before closing at 20,420.26, a drop of 4.76 points or 0.02 per cent. US is nearing the Thanksgiving holiday weekend, also impacted market movement across the globe. Indian markets too are seeing sideways movement. The 50-share CNX Nifty on the National Stock Exchange eased by two points to 6,057.10. Power, realty and IT shares led six of the 13 BSE sectoral indices down. IT stocks fell as the rupee continued to strengthen against the dollar, reducing the value of their overseas earnings when converted into the local currency. Fresh capital outflows affected sentiment. Overseas investors sold a net Rs 339.16 crore of shares yesterday, according to provisional data on the stock exchanges. The decline in the markets was stemmed by consumer durables and FMCG sector shares, which advanced. Brokers said there was volatility in the market as some investors booked profits while others sought to cover their pending long positions before the expiry of futures and options contracts tomorrow. The quarterly GDP estimate for July-September and fiscal deficit data is scheduled to be released on November 29. The rupee traded stronger at 62.2 levels against the dollar after a disappointing report on US consumer confidence in November.

The S&P BSE Sensex opened higher at 20,449. It traded within a band of 20,348.06 to 20,482.67 before closing at 20,420.26, a drop of 4.76 points or 0.02 per cent. US is nearing the Thanksgiving holiday weekend, also impacted market movement across the globe. Indian markets too are seeing sideways movement. The 50-share CNX Nifty on the National Stock Exchange eased by two points to 6,057.10. Power, realty and IT shares led six of the 13 BSE sectoral indices down. IT stocks fell as the rupee continued to strengthen against the dollar, reducing the value of their overseas earnings when converted into the local currency. Fresh capital outflows affected sentiment. Overseas investors sold a net Rs 339.16 crore of shares yesterday, according to provisional data on the stock exchanges. The decline in the markets was stemmed by consumer durables and FMCG sector shares, which advanced. Brokers said there was volatility in the market as some investors booked profits while others sought to cover their pending long positions before the expiry of futures and options contracts tomorrow. The quarterly GDP estimate for July-September and fiscal deficit data is scheduled to be released on November 29. The rupee traded stronger at 62.2 levels against the dollar after a disappointing report on US consumer confidence in November.

SENSEX LOOSERS

The major Sensex losers were

Bharti Airtel (-1.76 pc), NTPC (-1.41 pc), SBI (-1.23 pc), Sesa Sterlite (-1.22

pc) and Wipro (-1.06 pc). Hero MotoCorp was unchanged while Tata Motors firmed

up 2.31 pc, ITC 1.03 pc, ONGC 0.98 pc, Coal India 0.84 pc and Dr Reddy's

Laboratories 0.77 pc. Among the S&P BSE sectoral indices, Power fell 0.88

pc, Realty 0.77 pc, IT 0.66 pc and Teck 0.65 pc, while Consumer Durables rose

1.37 per cent, FMCG 1.03 pc and Auto 0.97 pc. The market breadth remained

negative as 1,362 stocks ended lower, 1,111 finished higher and 158 ruled

steady. Total turnover dropped sharply to Rs 1,828.15 crore from Rs 3,944.46

crore yesterday.

No comments:

Post a Comment