With

poor monsoon and food inflation continuing to remain a worry, the

Reserve Bank today kept key policy rate unchanged, giving no respite

either to borrowers or India Inc. RBI Governor Raghuram Rajan,

however, lowered the Statutory Liquidity Ratio, the portion of

deposits that banks are required to keep in government bonds, by 0.5

per cent to unlock about Rs 40,000 crore into the system. Bankers

said the RBI action does not provide room to cut interest rate and

hence the EMIs for home and auto loans will remain the same. Industry

chambers voiced disappointment saying that RBI should have cut the

rate to boost industrial growth. Rajan, who has for the third time in

a row kept the rate unchanged, said there are upside risks to

inflation in view of uncertain monsoon and its impact on food

production as also volatile international oil prices. "It

is...appropriate to continue maintaining a vigilant monetary policy

stance as in June, while leaving the policy rate unchanged," he

said at the third bi-monthly review of the monetary policy here.

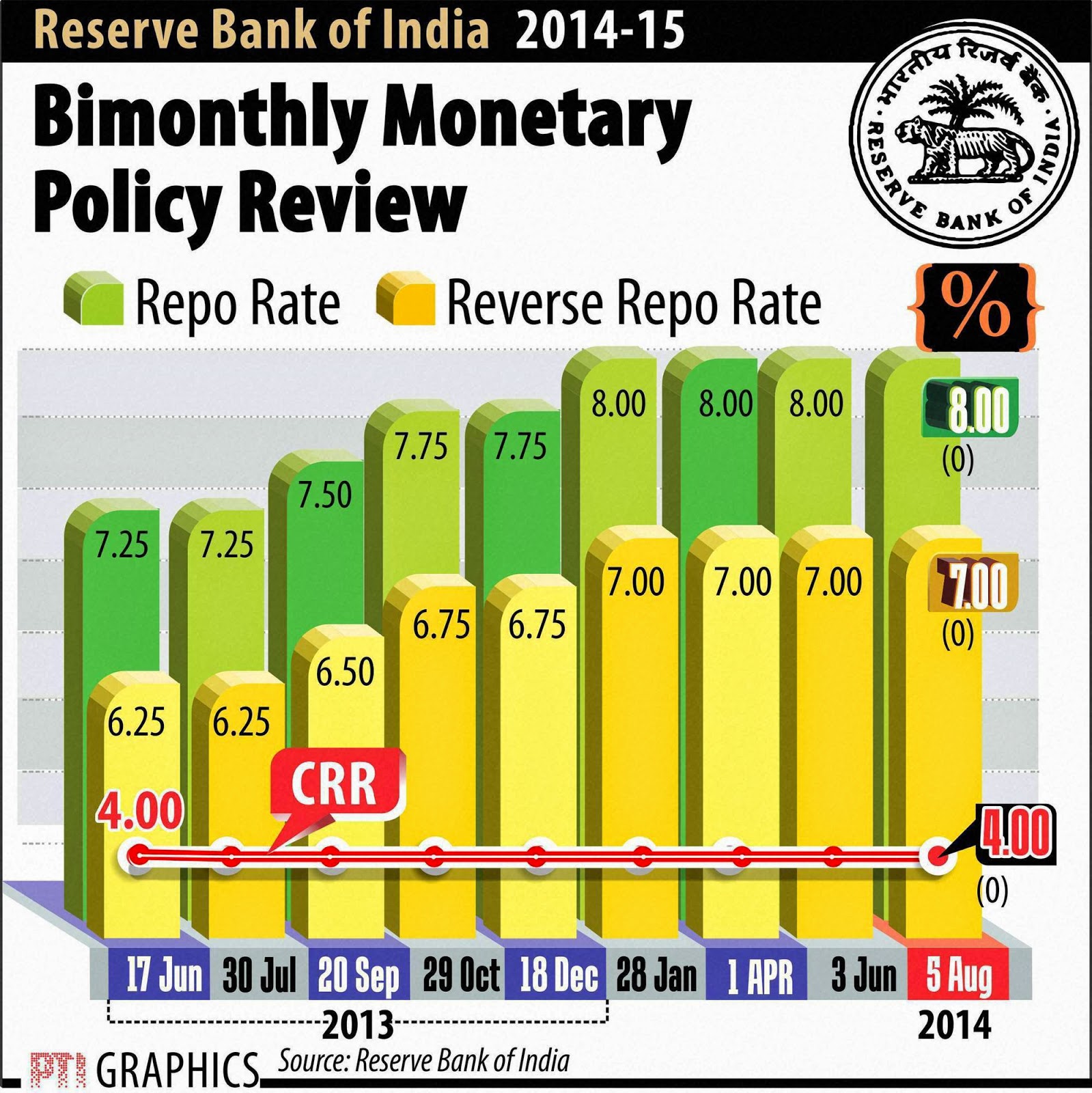

Accordingly, the repo rate will continue to stand at 8 per cent, the

reverse repo at 7 per cent and the cash reserve ratio at 4 per cent.

The bank rate would remain at 9 per cent. In order to infuse

additional liquidity, Rajan decreased SLR for banks by 0.50 per cent

to 22 per cent with effect from the fortnight beginning August 9. A

similar move in June had released an additional Rs 40,000 crore into

the system. Rajan hinted at more SLR cuts in the future in tandem

with the government actions on the fiscal deficit front to help

lenders plan for the long-term. Commenting on RBI action, Oriental

Bank of Commerce Chairman and Managing Director S L Bansal said

"interest rates are unlikely to come down in the near future.

The status quo would continue for some time."

Subscribe to:

Post Comments (Atom)

2030 నాటికి భారత్ "ఎగువ మధ్యాదాయ" దేశం

"భారత్ రాబోయే నాలుగేళ్లలో... అంటే 2030 నాటికి "ఎగువ మధ్యాదాయ దేశంగా రూపాంతరం చెందనుంది. తద్వారా చైనా, ఇండోనీసియాల సరసన స్థ...

-

fo r April 25, 2019 Closing Subdued Tithi : Chaitra Krishna Saptemi Nakshatra : Poorvashadha Persons born in Mrigasira, ...

-

fo r AUGUST 07 , 2019 Second Half Subdued Tithi : Sravana Sukla Saptami Nakshatra : Swathi Persons born in Krittika, Uttara,...

-

Stock Market created a Sunami on Monday as exit polls predicted NDA Government under Prime Minister Naredra Modi will get another term ...

No comments:

Post a Comment